The metaverse is touted by many as the next stage of the internet. But what exactly is it and how will the China system affect its development within the country?

The metaverse is shaping up to be a wild-west opportunity for economic development unprecedented in human history, with virtual worlds stretching out to infinity. It is becoming a global reality with blinding speed and China is determined to be at the forefront of it.

The term metaverse is increasingly being used for the next generation of the internet and describes the immersive and interactive shared virtual worlds that more and more people are accessing for work, play and life in general—and iterations of it have been around for longer than you might think.

While the concept is still in its infancy in terms of its application, some aspects are already present in gaming, entertainment and professional contexts across China, and many companies are betting big on it. Tech titans ByteDance, Tencent and Alibaba are among the more than 1,000 Chinese companies that have applied for metaverse-related trademarks. And in the US, social media giant Facebook has even re-branded itself as Meta Platforms in its search for metaverse dominance. The global market was valued at $500 billion in 2020 and is predicted by Bloomberg Intelligence to reach $800 billion by 2024, the value of the metaverse market in China is more difficult to calculate, but it is certainly growing extremely fast.

Current examples of the metaverse include apparently authentic virtual reality chat rooms that can be used in both personal and professional environments, virtual celebrities performing and and selling products on e-commerce apps—a market expected to be worth around $1 billion in China in 2021—and world-building and gaming software such as Roblox and Fortnite.

Virtual reality (VR) and augmented reality (AR) are fundamental components of the metaverse as the multimedia technologies are necessary for delivering immersive, interactive experiences to consumers. Both are still far from mainstream but there are a huge number of potential applications, as Alibaba demonstrated in 2018 when it launched an AR-infused shopping app called Taobao Buy that brings 3D versions of products into the real world.

“What is the metaverse?” asks Li Yang, Associate Professor of Marketing at CKGSB. “Is it wearing VR goggles, is it Facebook changing its name to Meta, is it playing Genshin Impact, swiping through Tik-Tok or buying NFT’s? In fact, the concept of the metaverse is still not entirely clear.”

But thousands of companies around the world are putting huge amounts of money into metaverse development and those viewed as being leaders in this new digital frontier are seeing massive increases in their share prices. Tencent’s management spoke at length about the metaverse on an earnings call in mid-August 2021, describing it as “a topic of great interest to us, albeit a longer term rather than an immediate opportunity.”

Days later, ByteDance acquired VR headset startup Pico Interactive for a reported RMB 9 billion ($1.41 billion), a deal that the TikTok owner said would support its “entry to the VR space and long-term investment in this emerging field.”

But not everyone in China’s tech circles has caught the bug. “The metaverse concept is heading toward a peak of over-anticipation,” said Baidu vice president Ma Jie in November 2021. “I believe the bubble will burst in the second half of next year or the year after. When the tide goes out, you will be able to see who’s holding trump cards or their underwear.” This view, however, hasn’t stopped Baidu from joining the fight for metaverse-related trademarks.

The metaverse’s Big Bang

The prevailing opinion is that the metaverse is the inevitable successor to the internet. The term comes from American author Neal Stephenson’s bestselling sci-fi novel Snow Crash from 1992, where it referred to a shared virtual cityscape that is inhabited by both human-controlled avatars and digital “daemons.” Although Stephenson later said he was just making things up, his novel had a huge impact, including on many movies such as The Matrix, and to some degree the development of the internet itself.

But the concept arguably dates as far back as the 1980s, when text-based interactive games such as multi-user dungeons (MUDs) emerged shortly after the dawn of the internet, according to Wei Cai, associate professor at the Chinese University of Hong Kong, Shenzhen (CUHK), who coauthored a research paper this year about the metaverse’s potential for social good.

Among the numerous interactive games was TinyMUD, which permitted players to create a game world for others to explore—one of the earliest instances of user-generated content, another pillar of the metaverse. From there, the internet advanced with rapid improvements in computing power and computer graphics, from early virtual open worlds in the 1990s to modern prototypes of the metaverse such as Second Life in 2003, Roblox in 2006, Minecraft in 2011 and more recently Fortnite.

And there were aspects of the metaverse on show in the early days of the internet in China, such as Tencent’s QQ Show. “Many years ago, it had a business model of advertising on social networks, however this was upgraded to a virtual commodity system where virtual products were sold online,” says Li Yang. “QQ to a large extent incorporated elements of the metaverse in its model—it was virtual, belonging to the spiritual world, and it was purely based online; nonetheless it gave people a space to be creative, to express themselves.”

“[Tencent’s QQ Show] even had its own payment method via QQ coins, thereby creating this closed-loop ecological system of the metaverse,” adds Yang. Tencent started selling the QQ coin for RMB 1, but it has since jumped in value after online vendors started accepting virtual coins for real-world items. In 2019 alone, the Chinese virtual coin market was worth $900 million.

And the metaverse is continuing to be built upon various emerging technologies, including cryptocurrencies, such as QQ coin, and blockchain. For instance, the Argentina-based metaverse platform of Decentraland runs on the Ethereum blockchain, which is used to track ownership of virtual real estate and underpins the in-world cryptocurrency, MANA—which can be bought and sold for real-world cash. In mid-2021, the platform gained attention when a plot of digital land sold for the MANA equivalent of $913,228.

Facebook’s rebranding into Meta means that the company is the most-visible global player in the space, but other heavyweights are also active. In 2020, Taiwan-based telecoms giant HTC launched the enterprise-focused VIVE XR Suite, a VR software bundle that increases the realism of remote or virtual business meetings. And Google’s parent company Alphabet, is using a number of its advantages to become a big player in the metaverse, including the fact that it has the most popular smartphone operating system in the world and is essentially the world’s largest data store, not to mention the myriad companies it owns that produce hardware to connect users to the internet.

Among governments, South Korean authorities have been quick off the mark to explore the concept. Seoul is encouraging public-private partnerships to advance the technology, and in May last year, the Korean government launched a national “metaverse alliance” to coordinate and facilitate the development of VR and AR platforms. China is following suit and in October 2021, state-owned telecoms company China Mobile set up the Communication Association Metaverse Committee (CAMC), the aim of which is to study national industrial policy and strategy. The CAMC admitted 17 new members in February this year and looks set to continue expanding.

China’s metaverse

Unsurprising given the governments encouragement of and Chinese consumer’s eagerness to embrace the more digital lifestyle, the metaverse has a strong foothold in China.

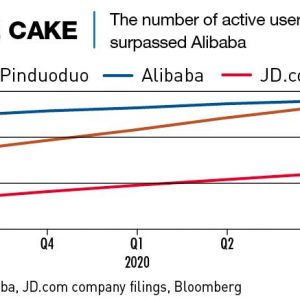

By early 2022, more than 1,300 companies in China had registered trademarks for terms related to the metaverse, while applications to register around 10,000 trademarks have been filed, according to business tracking firm Tianyancha. The companies holding the most metaverse-related trademarks are Tencent, ByteDance, Alibaba, Baidu, NetEase and Xiaomi.

Tencent got an early start in the latest iteration of the metaverse when it became the China distributor for the metaverse platform Roblox in 2019. The company has the opportunity to dominate the metaverse in China through its ubiquitous do-everything app WeChat, according to Catherine Henry, a senior vice president for growth at digital content agency Media.Monks and an expert on the metaverse.

“Looking at WeChat, if you uploaded all that into a headset, you pretty much have the metaverse,” says Henry. “If we’re looking at interoperability, a rich commercial ecosystem, and a committed and loyal customer base, you have all of those things in WeChat.”

But importantly, Tencent is also an investment powerhouse with stakes in more than 800 companies, from Tesla Motors and Spotify to Fortnite and Roblox. “It’s incredibly impressive and so I believe there is a real opportunity for the metaverse to flourish in China in a way that it may take longer in the US because interoperability is key,” says Henry.

ByteDance, owner of TikTok and popular Chinese news app Toutiao, has been busy laying the groundwork this year for creating a metaverse that will seemingly be founded in gaming. On top of its billion-dollar acquisition of VR headset startup Pico, ByteDance has pushed aggressively into gaming with acquisitions of small, independent Chinese studios such as Shanghai-based Moonton Technology and C4games from Beijing, along with an investment in Mycodeview, the Beijing-based developer behind Reworld, a domestic clone of Roblox.

The hype around the metaverse has led to frothy valuations for Chinese-listed companies linked to the concept. This prompted the state-owned Securities Times to warn against investing in the metaverse as the products were still in their infancy. “Investment is not a virtual game,” the newspaper warned in September, adding that if people “blindly invest in such grand and illusionary concepts as the metaverse, they will be burnt in the end.”

Daniel Ahmad, senior analyst at Niko Partners, says it is still early days for gaming metaverses in China. “Numerous small and medium-sized gaming companies have announced their own plans, but none of them have anything tangible to show and may not necessarily have the experience to build a complete product in the same way that larger firms could,” he says.

Still, China lends itself to the metaverse in numerous aspects. The country’s competency in core technologies such as artificial intelligence and 5G networks, coupled with a longstanding and unrivalled dominance of consumer device manufacturing, and societal embrace of super apps gives it a major advantage, according to Henry.

“If I look across the entire spectrum of AI, 5G, digital experiences and technologies, China really stands out in a number of these areas, if not all of them,” says Henry. “All the foundations are there, which makes it a really exciting space for China right now.”

Metaversal laws

But while the building blocks are there, there is some uncertainty about how much China’s metaverses will resemble and connect to those in the West. For instance, Alex Xu, Chief Executive Officer of MultiMetaverse, a Shanghai-based animation studio for metaversal content, says Tencent’s investments mostly suggest it sees a lucrative opportunity for revenue from live events and brand partnerships with little focus on user-generated content (UGC), which is generally a hallmark of the metaverse concept everywhere else.

While games that allow for UGC exist in China, there are strict restrictions and moderation protocols that dictate what is not allowed, according to Ahmad. “Therefore, we believe the UGC aspect presents a risk to the growth of metaverse games in China.”

But creation and fun are the fundamentals of the metaverse, according to Xu. “If you cannot create fun in that virtual world, people won’t spend time and money in that world at all. Even if you have the infrastructure, if the content there is not attractive, you’re doing nothing.”

This leads to a discussion of the relative prospects of the Western metaverse’s more unfettered character and the Chinese government’s centralized approach. The connection between government control, gaming and the metaverse also links the fortunes of the latter with China’s online gaming industry, which has been hit by playtime restrictions aimed at curbing video game use among minors.

Other headwinds could be looming for metaverse development in China as well. In late October researchers at a government think tank affiliated with China’s Ministry of State Security warned that the metaverse’s “technological characteristics” and “development patterns” had national security implications, giving Chinese companies a reason to look over their shoulder at incoming regulations in a way that Western developers don’t have to.

The researchers reported that given the potential for the metaverse to lead to major changes in political, economic, cultural and social structures, the authorities were focused on creating the necessary regulatory supervision and guidance to ensure national security. Decentralization of power and control over activities is one of the key principles underlying the metaverse globally, but that flies in the face of Beijing’s resolve for control over all aspects of life, both real and virtual.

CUHK’s Cai says a metaverse offers plenty of room for experimentation—including in areas such as social systems—which could spook Chinese authorities and persuade them to shackle such virtual realities. “If our policy is that we would like to have a very secure, stable and controllable metaverse, then it might well be a virtual space where people can interact, but it’s nearly impossible that they might create something new or interesting.”

The possibility that the metaverse encourages decentralization—often touted as an important element of metaverse development—may sharpen Beijing’s resolve to mold the metaverse to its liking. Decentraland, for instance, is owned and governed by its users, who can submit and vote on proposals that determine the future of the virtual world. “From a governance standpoint, it’s very different,” says Dave Carr, a spokesperson for Decentraland. “I think this becomes an issue for all governments when people start spending more and more time in the metaverse. Which is not to say that traditional government will be replaced, but a metaverse like Decentraland has been designed to put power in the hands of its users.”

The Chinese government’s attitude toward cryptocurrencies could prove instructive. While Beijing has banned cryptocurrencies and the mining of them, financial regulators have recognized the value of a digital currency built on a blockchain and sought their own implementation in the form of the digital Renminbi.

“The general sense in China is that blockchain is good, cryptocurrency is bad,” says Cai. “I believe the same thing will happen with the metaverse as well.In China we like optimizations and efficiencies so our metaverse might be used to further accelerate the digitalization of the government and public services.”

One world or two?

Right now, in spite of the restrictions, many companies in China are eager to avoid missing out and are looking for first-mover advantage in the metaverse, staking a claim to a brave new virtual world before the scaffolding is even fully built. But even at this stage, it seems the Chinese version of the metaverse is shaping up to diverge quite significantly from the rest of the world’s.

“I feel that the possibility of two ecosystems being developed is not only possible, but very likely,” says Catherine Henry. “It is not necessarily a bad thing and eventually bridges will be built between them. The Chinaverse will be connected to the metaverse in some places and brands will be able to operate in both markets, but it may be a bit of a walk [between them].”

And while it’s early days, the lack of developmental control over the metaverse in the West, compared to the somewhat restricted nature of the Chinese metaverse leads some commentators to say that the Chinese version will end up taking a back seat.

“The metaverse is obviously going to develop further and faster in the absence of controls,” says Wei Cai. “And the Chinese government’s insistence on oversight of aspects of the metaverse, which are developed in the West with hardly a thought to regulation, has to have some impact on the speed of the development of the Chinese metaverse—meaning it will most likely play second-fiddle to the Western metaverse.”