Prophets of doom say 3D printing will overturn manufacturing in China. They are both right and wrong.

Wisps of smoke rise from nowhere as an invisible beam silently traces a path inside one of the three-dimensional (3D) printers at Beijing Longyuan Automated Fabrication System (AFS).

The printer is in the early stages of making a part for an aerospace company. An infrared laser inside the refrigerator-sized machine follows a preset course as it burns a bed of powdered aluminium to fuse it into a solid layer.

It can be a slow-going process. A look through the printer’s inspection window shows what resembles pools of liquid on the bottom of the build chamber, while a nearby printout of the final part depicts an intricate concept riddled with nodules and voids.

AFS’s factory on the outskirts of Beijing in Shunyi district is small and unassuming.

But the eight machines inside the squat, nondescript buildings are blazing a trail in the process known in industry circles as additive manufacturing. Its popular moniker is 3D printing.

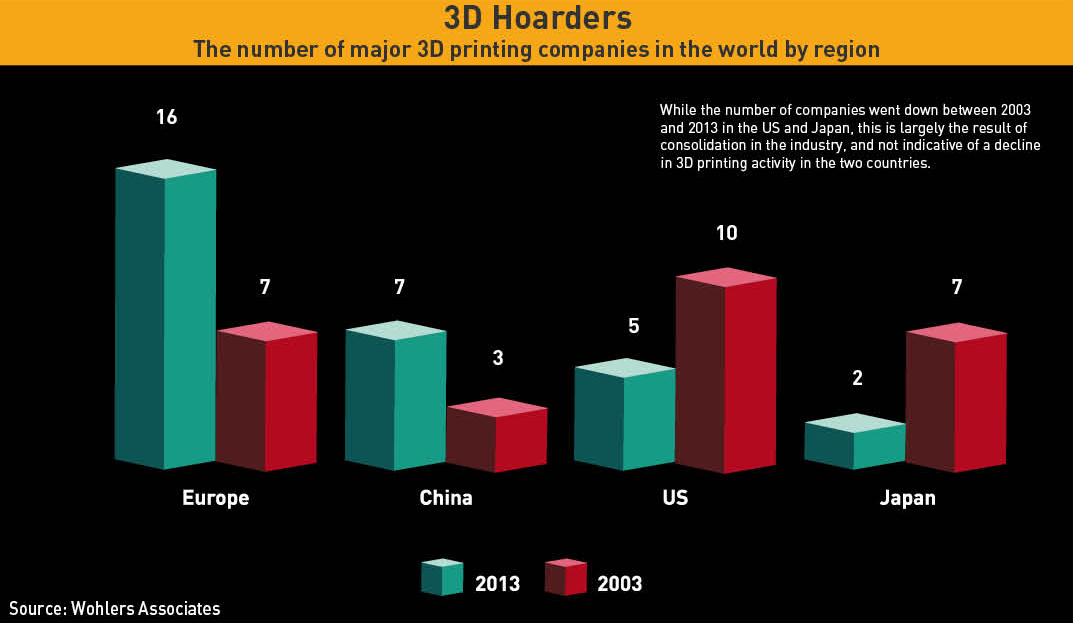

Founded in 1994, AFS was one of the first 3D printer makers to emerge in China. Its main line of business is selling the laser-sintering machines that turn software blueprints into objects by building them up in thin layers from particular materials. AFS’s printers can use powdered metal or foundry sand on top of each other, says William Zeng, Deputy General Manager at AFS, while other machines extrude molten plastic through a nozzle.

Additive Evolution

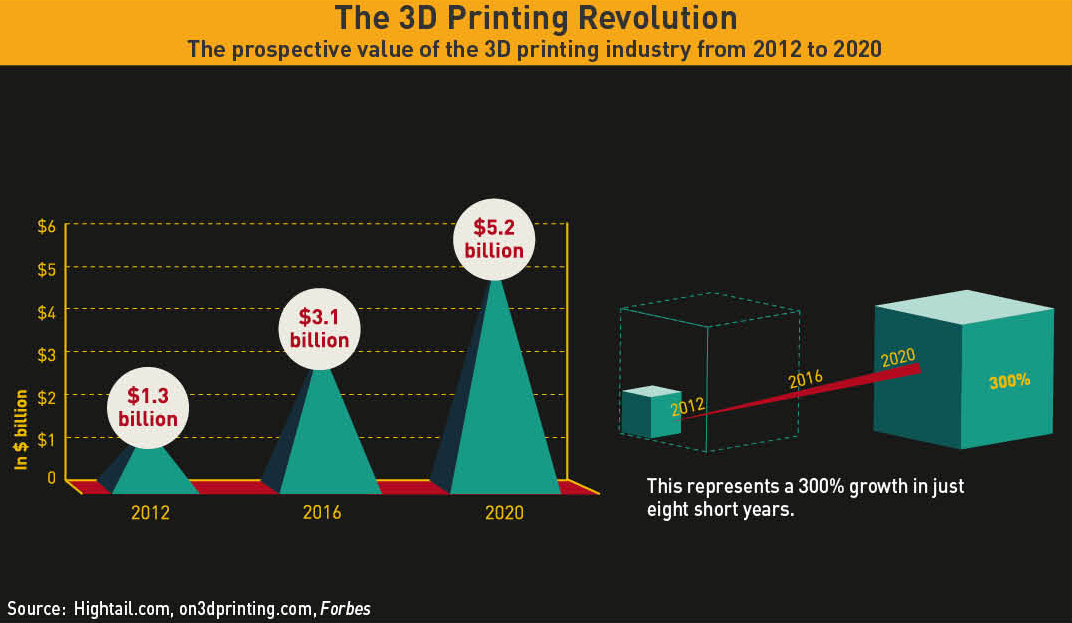

Additive manufacturing is not short on hype. Supporters say the technology has the potential to reshape the way we design, produce and manufacture new things— and make it easier and more cost efficient to create existing objects. That carries implications for global manufacturing and the country in the middle of it all, China. Additive manufacturing could challenge Chinaʼs attraction as a large-scale, low-cost production hub—or alternatively augment it.

More than a decade before AFS set up shop, Charles ‘Chuck’ Hall invented the first additive manufacturing technique in the United States in 1983. According to 3D Systems’ company history, the first thing Hall printed using his method, called stereolithography, was a humble teacup—which he gave to his wife.

Hall’s process sparked a slew of other 3D printing technologies that have become widely used in a range of niche industrial applications.

“It includes a whole umbrella of technologies. What they have in common is a core process of building up projects layer and layer, by laying down and patterning material,” says Anthony Vicari, Research Associate at innovation-focused consultancy Lux Research in the US.

But while enterprise use expanded quietly over the past three decades, public interest did not take off until the emergence of low-cost 3D printers for consumers and hobbyists in the mid-2000s.

“All these processes have been in development for 10, 20, sometimes 30 years, but for the most part, they’ve been limited to the industrial world, because the cost of the printers has just been enormous. Even today, if you want to print titanium alloys for aerospace, that printer is going to cost you $500,000 to a $1 million or so,” says Vicari.

Additive manufacturing has also piqued the attention of the global factory that is China. Companies like AFS are riding a wave of local interest in the process, evidenced by the excitement at the second World 3D Printing Technology Industry Conference, held in Beijing in June. “The buzz was unprecedented in comparison to other industry events,” says Tim Caffrey, Senior Consultant with Wohlers Associates, a consultancy that tracks 3D printing.

“CCTV recorded a Q&A hosted by one of its popular on-screen personalities, and the audience was snapping photos at an amazing rate.”

The Chinese government has also picked up on the trend by forming the China 3D Printing Technology Industry Alliance. The group aims to shepherd development of the domestic industry and is involved in planning 10 innovation centers in 10 cities that will cost RMB 20 million in total.

Outside of China, American firms head a pack of about a dozen major 3D printer makers that preside over the global market. Charles Hall’s California-based 3D Systems is the largest globally, followed by Stratasys from Minnesota. Both are present in China, where they vie with leading homegrown players such as AFS, Beijing TierTime Technology (which as of May was the largest producer of 3D printing systems in China), Hunan Farsoon High-tech and Wuxi FalconTech.

Prototypical

In China, 3D printing has carved out a niche in the advanced and high value-added manufacturing sector that involves complex parts and exotic materials. Take the automotive industry for instance—3D printing is a boon for designers and engineers because it allows objects with complex designs, like interior voids that minimize weight without sacrificing strength, to be made much cheaper than traditional methods. Additive manufacturing cuts out the long lead times and design techniques like metal cutting or molding.

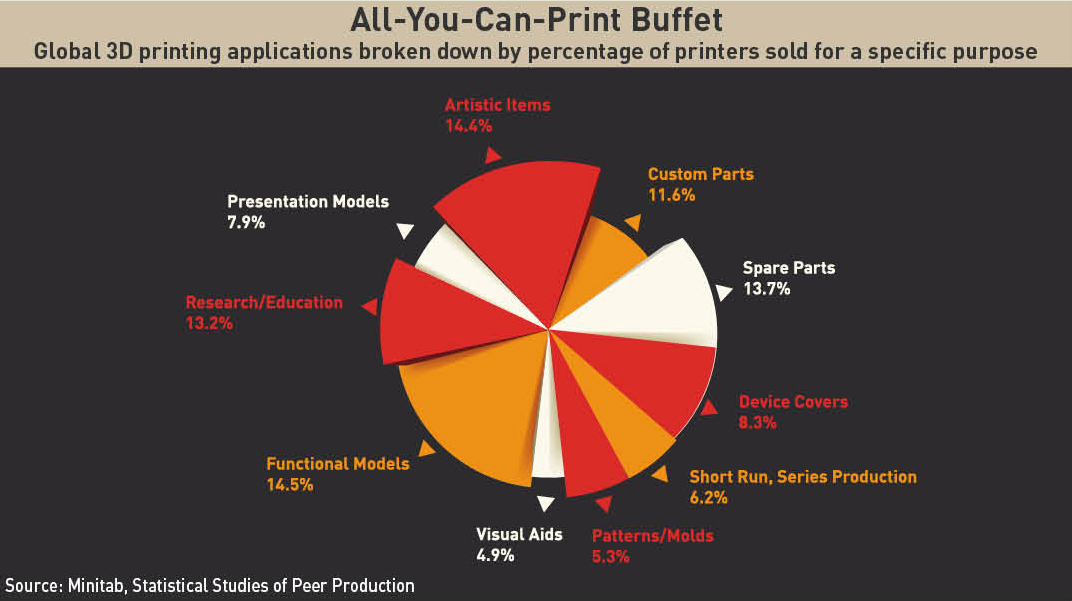

“Today prototyping is still the main news. That’s the application that has really built up the industry in the first place,” says Vicari. “Things that wouldn’t be ‘machineable’ or moldable at all… are much easier to make.”

“If there’s something wrong, you can make changes directly… and make it again,” says Kim Francois, China Chief Representative for Materialise, a Belgian company specializing in 3D printing. She says the process saves time and money because molds can cost up to RMB 150,000 and take two months to make.

Turnaround can also be significantly shorter in some cases. Sitting on the floor of AFS’s boardroom is an aluminium transaxle case for a car that was printed in less than a week, but would have taken 3-6 months to machine from a block of metal.

The efficiency of 3D printing also means production costs can be a fraction of current methods. When Lockheed Martin and the Oak Ridge National Laboratory in the US teamed up to make titanium alloy brackets for the engine of the F-35 fighter jet, they discovered the shape was so complex that machining it left 97% of the material on the floor. With 3D printing though, only 9% was wasted and the money saved from material scrap more than halved the cost of the bracket.

Rapid prototyping generates around 30% of AFS’s revenue, and the business counts some of China’s biggest companies as clients. Its most expensive 3D printers, costing RMB 1.6 million, are used by Chinese automakers Geely, FAW and Dongfeng Motor to produce experimental engine parts, says Zeng.

Aerospace is another area where 3D printing is taking off. One of the largest printers in the country is about the length of a bus and belongs to the National Laboratory for Aeronautics and Astronautics at Beihang University in Beijing.

Although AFS did not make it, Zeng says the machine is being used to design large and complicated parts for China’s home-grown competitor to the short-haul airliners made by Boeing and Airbus. AFS itself has also worked with AVIC Dongan, a subsidiary of the country’s dominant aerospace and defense contractor Aviation Industry Corporation of China.

Rapid prototyping appeals to those designing cars or jets, but another strength has entrenched 3D printing in health care. AFS’s cheapest machines—costing around RMB 680,000—are popular with medical companies and hospitals, including Peking University Third Hospital, one of the top clinics in the country.

Infinite customization is behind the health care industry’s embrace of 3D printing. The technology makes it possible to personalize products on a massive scale— useful for a sector where every patient is unique. Today’s prosthetics and implants for use inside the human body already come in a variety of sizes and designs, but 3D printing can improve them by tailoring devices to each patient’s biology or injury. Bespoke implants mean better compatibility and fewer trips to the hospital, which could potentially ease the strain on China’s already stretched social security system, and it is where Materialise hopes to leverage its expertise in 3D printing in China. The Belgian company is looking to work with doctors to design devices like jaw implants from scans of patients’ mouths, says Francois. The digital models would then be printed in medical-grade titanium.

Out with the Old

Some of the mania around 3D printing has circulated the potential threat it poses to mass manufacturing—the kind that has come to define China’s economy. It comes as no surprise then, that traditional producers have pooh-poohed the idea of 3D printing threatening ‘Made in China’.

A “gimmick” is how Hon Hai Precision Industry Co. Chairman Terry Gou reportedly summed up the technology in June. Most of the 1.3 million employees at Foxconn, Hon Hai’s giant electronics manufacturer and iPhone maker, are in China and they staff the massive factories that churn out goods for Apple, Samsung and other multinationals.

“If we’re talking about the kind of manufacturing that Foxconn does, then for the most part, 3D printing will not be applicable. But within the applications where there is a case for 3D printing, it’s definitely not just a gimmick. There’s a lot of hype surrounding it today but there’s a lot of reality too,” says Vicari.

While additive manufacturing looks unlikely to supersede conventional production processes, there is scope for the technology to enhance the kind of low-cost, mass manufacturing that has propelled China’s economy over the past three decades.

What has piqued Beijing’s interest is that the vast army of traditional manufacturers in China can leverage 3D printing to produce and modify molds for production use with ease.

“It assists the conventional manufacturing processes because you can make or modify the existing mold fairly quickly,” says Vicari. “There’s definitely an adoption among some of the manufacturers there for some of those uses.”

Hasta Logistics Baby

There are other ways where 3D printers could make routine production of parts more efficient. An assembly plant—like those run by Terry Gou’s Foxconn for example—with a faulty production line would typically need to order spare parts from an injection molding company, which would then need weeks to shape and ship the items. But a 3D printer onsite could create a replacement in hours.

“You can print on demand, which is one of the big advantages of 3D printing,” says Francois. “It’s only on request, which is great because you throw away less things. You don’t need to rent out big warehouses to put in your stock, and then realize after two years, nothing has sold, [so] throw it away. It saves money and it’s good for the environment.”

The long-term impact on supply chains could be profound. As companies start using 3D printers to produce parts on demand, on site and only as needed, a plethora of players—from storage to shipping—would lose out in a shorter, simpler supply chain, while consumers would benefit through localized production and leaner inventories.

Take, for instance, an offshore oil rig that needs a component replaced. Today, that would necessitate the replacement part flown in at great expense from inventory stored at a costly warehouse. If stock no longer exists, then the rig operator will need to fork out for an expensive one-off production run of a legacy part.

With a 3D printer on hand, the same component could be ready in hours. Costs would come down as storage and shipping are no longer needed, and through the elimination of capital investments such as moulds, casts and machine tools.

In a study back in July, IBM disassembled three products—a cell phone, a hearing aid and a washing machine—and determined the cost of manufacturing and distribution in a simulated supply chain based on 3D printing. The washing machine had 63 mechanical parts, each of which can be made by a single 3D printer instead of 63 separate stamping and molding parts and a production line. IBM found that the supplier base could be reduced from between 30 and 60 suppliers to one or two.

Localized production of higher-value goods carries implications for China’s position in global manufacturing, especially if the cost of 3D printing comes down and the quality and reliability of printed parts improves. In that scenario, Vicari says there would be less reason to build a factory in China, particularly for highly automated technology.

That could accelerate the so-called ‘re-shoring’ of American and European manufacturing operations, as companies would no longer need to incur the cost of shipping raw materials and components in, and products out, over long distances.

For now, 3D printing is not about to replace mass production—not for another decade at least. “Anything in quantities of tens of thousands or hundreds of thousands of units [is] still going to be made using conventional technologies. The main impact of 3D printing is going to be the prototyping and design phase for high-value goods. Or potentially even down the road for replacement parts, where having something local on site has additional value,” says Vicari.

In a Material World

Judging by Terry Gou’s comments though, additive manufacturing hassomething of an image problem among China’s factory bosses. Though 3D printing can play an evident role, some limitations mean it has failed to gain traction in the mainstream manufacturing world.

Chief among them is that it can take anywhere from hours to days to print an object. While that may be an improvement for applications like rapid prototyping, it is impractical for larger-scale production. An assembly line in Shenzhen can churn out a product in the hundreds of thousands or even millions in the same amount of time it takes to print a component. “It’s an order of magnitude slower than what it’d need to be,” says Vicari.

Materials are another problem. The compounds used to print objects are expensive and only a handful can be used due to the required performance standards. Titanium is popular for printing industry-grade parts because the metal is lighter and stronger than steel, but Zeng from AFS says titanium alloys made in China cost RMB 3,000 per kilo and RMB 5,000 for imported varieties. Plastics can be pricey too: RMB 1,000 per kilo from the US versus RMB 400 from China. AFS often opts for foreign feedstock, as the better quality can be telling in the printed product.

Materials used in conventional manufacturing can cost 10 to 100 times more by weight when sourced for a 3D printer. The mark-up is partly due to the higher purity and composition standards required for 3D printing. It is also because there are still a small number of suppliers. “For many of these materials, you have to buy from the printer supplier,” like the way consumers buy ink cartridges from desktop 2D printer makers, says Vicari. But analysts expect material prices will fall and the list of options will diversify, as third-party suppliers enter the business.

Materials are not the only thing AFS imports. Laser systems made in China are too unstable to be used in AFS’s industry-grade printers, so the company imports lasers from Coherent in the US that cost more than RMB 100,000 each. The scanners in AFS’s machine used to map objects are from Germany and cost between RMB 150,000-250,000. Importing equipment is expensive and trims the cost advantage of 3D printing against today’s mass manufacturing processes.

While additive manufacturing struggles to take hold on the Chinese factory floor, the advent of inexpensive printers has spawned an expanding ‘maker movement’ of local hobbyists.

“Huge” is how Materialise’s Francois describes this enthusiast side of China’s 3D printing market, which she notes is being spurred by the growing low-end printer market. But she cautions that while there is sizeable public interest, a learning curve is involved.

“It’s not there yet that laobaixing [ordinary people] can just pick a printer up off the street and say, ‘this is my desktop printer, let’s use it.’ It’s not there yet: you need to have some knowledge… an interest. You need to be able to play with the software and the machine a little bit to be able to print out a decent product.”

Whether consumers will want to print simple goods at home is another question. Zeng and Francois both say no, pointing out that consumers today can print digital photos at home but almost never do, preferring the expensive, high-quality machines found at thousands of photo counters and shops.

“If you want to have a nice picture printed, you still go to your printer shop. It’s basically the same. If you want to print something that you have made at home, you can use your 3D printer at home. But if you want a really high-quality good, you will still go to the 3D printer shop,” says Francois.

At-home printing will not become widespread until printers become more reliable and the tools for using them more intuitive. In the meantime, so-called ‘service bureaus’ like Francois’s Materialise will bridge the gap by offering users a far easier entry point.

The company offers on-demand printing, with 90 printers of differing technologies in Belgium. Customers can upload their schematics to an online platform, select materials and have the final product shipped worldwide.

For designers then, additive manufacturing may live up to the hype. The technology opens up possibilities that were previously off-limits due to the constraints of typical production processes. “Industrial designers are educated in a way that they need to think about what they can make… with 3D printing, you can put that aside,” says Francois.

Education in general is poised to reap benefits from the spread of low-cost 3D printing, as schools and academia start integrating the technique into their lessons and curriculum.

Economies of scale and the pace of production mean China’s mass production model bests additive manufacturing for low-cost, high-volume goods. But it is difficult to say how long that advantage will last as 3D printing technology improves.

Rather than pose a threat, 3D printing could instead augment China’s factories. Opportunities exist to make mainstream manufacturing faster, leaner and more efficient. And with China moving up the industry value chain, the integration of 3D printing makes sense for improving development and central processing at factories. Not a threat, but also not a gimmick—3D printing will build upon what’s currently possible to reshape the world.