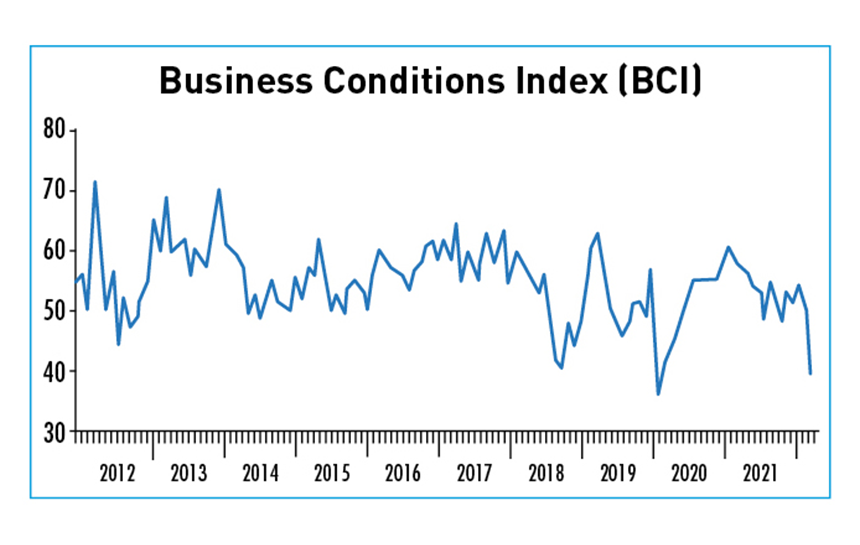

CKGSB’s Business Conditions Index, reflecting confidence levels in China business, shows the serious effects of COVID-related lockdowns

The BCI is directed by Li Wei, Professor of Economics at the Cheung Kong Graduate School of Business

The April CKGSB Business Conditions Index (BCI) fell to 40.8 from 51.3, well below the confidence line of 50.0, reflecting impossibly hard times. The ten-point drop indicates that our sample of successful business owners in China are very pessimistic about business prospects for the next six months.

All but the industry competitiveness index have fallen. But this only benchmarks our sample against their rivals, and says nothing about operating conditions. For this reason, we can say there was an overall decline in confidence in Chinese business in April. Since the BCI and its related indices look to the upcoming six-month period, this means difficult times ahead. Comparing today with the situation over the past two years, we see the current situation is just as severe as that of March 2020, when the original COVID-19 lockdowns were in place, and GDP growth in the second quarter will reflect this.

Introduction

In June 2011, the CKGSB Case Center and the Center for Economic Research initiated a project to gauge the business sentiment of executives regarding the macro-economic environment in China—calling it a business conditions index. Under the direction of Professor Li Wei, the two research centers designed and tested the BCI survey in July 2011. In September 2011, the first survey was carried out. 124 surveys have now been completed between May 2012 and April 2022 and 120 reports published.

The CKGSB Business Conditions Index (CKBCI) is a set of forward-looking diffusion indicators. The index takes 50 as its threshold, so a value above 50 means that the variable that the index measures is expected to increase, while a value below 50 means that the variable is expected to fall. The CKGSB BCI uses the same methodology as the PMI index.

Key Findings

- • All but one of the BCI indices fell in April due to COVID-related restrictions in place across the country

- • The short- and medium-term outlook for companies predicts tough times ahead

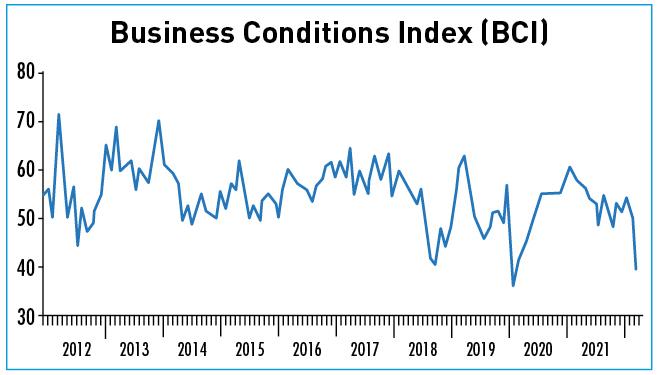

- • The Corporate Profit Index dropped from 53.2 to 35.3

Analysis

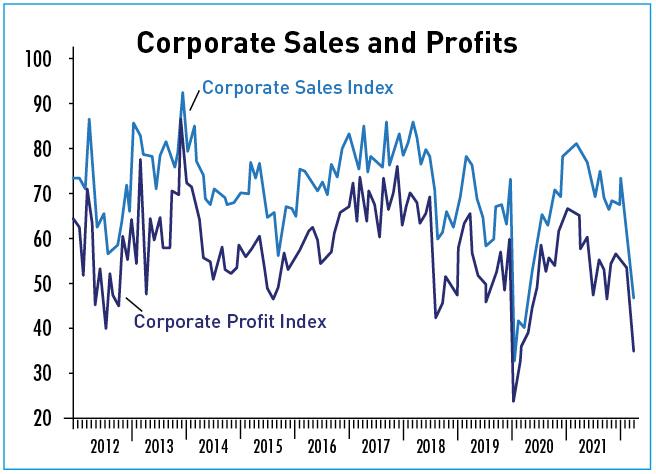

The CKGSB BCI comprises four sub-indices: corporate sales, corporate profits, corporate financing environment and inventory levels. Three measure future prospects and one, the corporate financing index, measures the current climate.

This month, all four fell. The corporate sales index fell from 67.3 to 47.0, and the corporate profit index dropped from 53.2 to 35.3.

Corporate financing prospects continued to struggle, with the index down from 46.2 to 41.9 this month. The inventory index fell again, from 41.9 to 40.6 this month. In terms of inventory and finance, the companies in our sample have had a persistently negative outlook ever since our survey began in 2012, and this month is no exception.

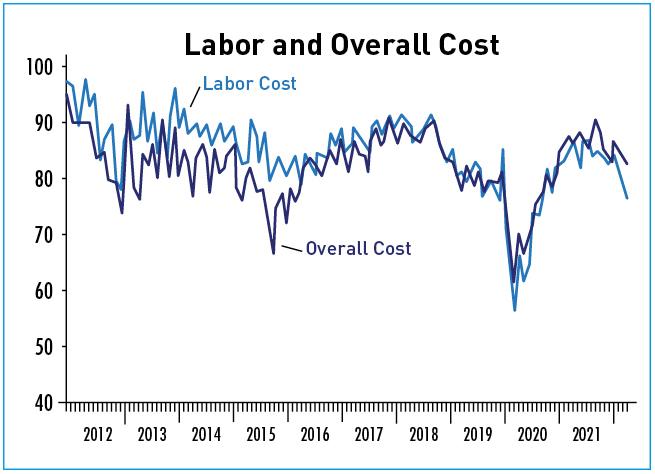

April’s labor cost forecast registered 80.5 compared to 76.6 in March. Overall costs also fell from 85.6 to 82.9.

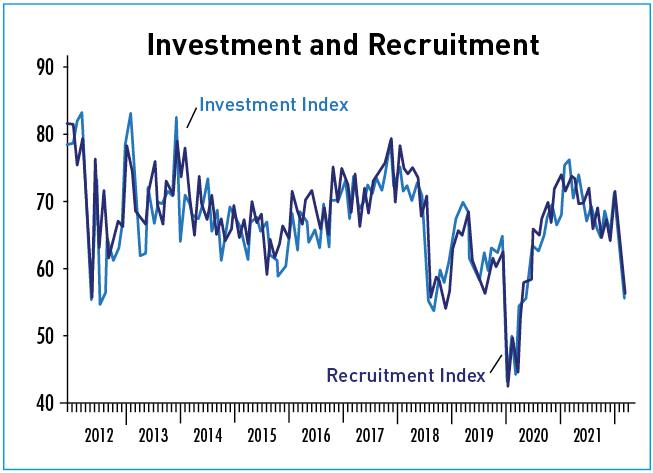

The investment and recruitment also experienced a sizeable drop. These indices have been consistently at the more confident end of the scale since the BCI began. In recent months, both have trended downwards, especially recruitment. Both indices fell this month, with confidence in investment prospects dropping to 55.7 from 62.6 from last month, and the recruitment score to 56.7 from 66.2 last month.

Conclusion

The country’s battle with the Omicron variant through strict measures to prevent its spread, has been disastrous for the economy. Logistics has been heavily impacted, with many transportation holdups that have added to financial pressures.

In addition to maintaining the healthy flow of logistics, we need to keep work and production up and running, especially for small and medium-sized enterprises. The government and society as a whole need to stand behind companies, giving them financial support to tide them over until the situation improves.

In addition to supply side issues, demand also needs attention. Allowing people out of their homes, especially in areas that have been mainly cleared of infections, is an essential first step. After so long indoors, incomes will have dropped sharply, and spending power too. This is a good time for the government to exert its macro-economic power. Consumer coupons could be used to encourage consumption, to not only meet the consumption needs of residents, but also to boost sales issues on the supply side.

Under Shanghai’s strict quarantine rules, many foreign employees and experts have left the city or country. These are people who bring with them the latest technological or managerial knowledge and promote the development of China’s economy, and they are needed. We hope that these professionals from overseas will be offered certain preferential policies, such as lower income tax rates, in an effort to keep them in the country.