The Chinese economy’s growth model has created a serious overcapacity problem that will continue to derail future growth unless tackled now.

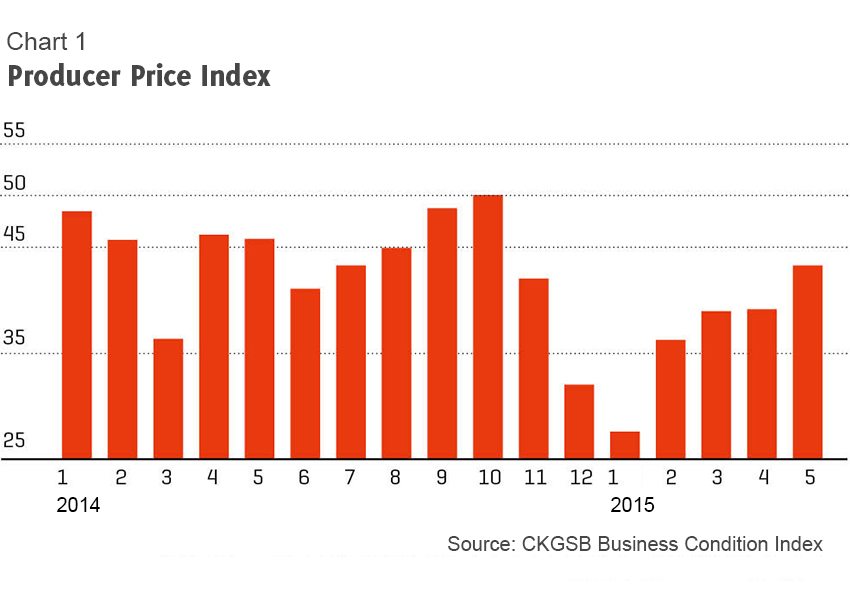

Last week, China released the producer price index (PPI) for June, which fell 4.8% year-on-year. It’s the 41st consecutive month that the index came in negative. This trend was also reflected in the CKGSB Business Condition Index, which measures the businesses’ expectations for a variety of conditions for the next six months. As you can see in Chart 1, the sub-index of intermediate products price has been well below the 50% threshold since January 2014; it hit a low of 28.1 in January 2015.

Falling producer prices is a key reflection of China’s overcapacity problem, especially in the heavy chemical industries. As a result, the local economy of regions that rely heavily on these industries has been in great trouble, and one typical example is the three northeastern provinces (Heilongjiang, Jilin and Liaoning).

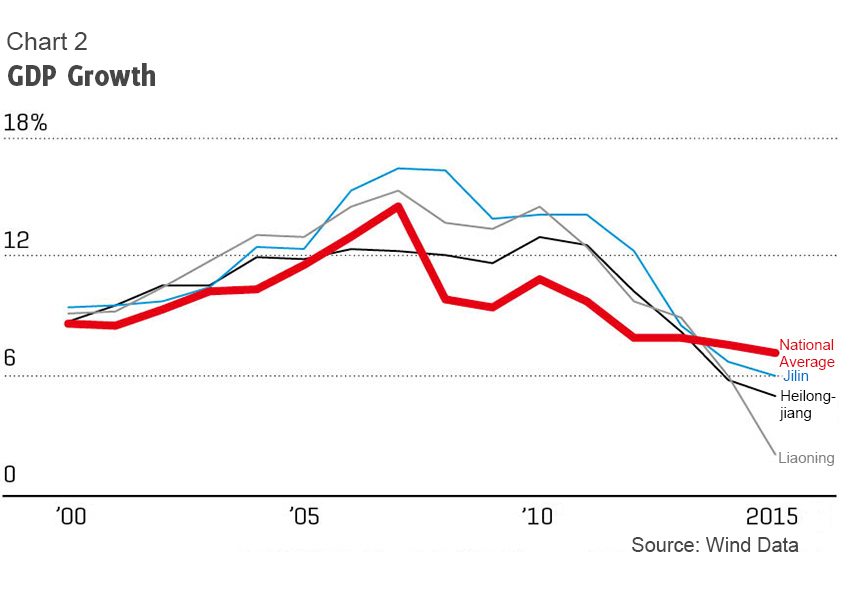

Traditionally, the three provinces have been the country’s major industrial bases. And in recent years, under the guidance of the government, lots of resources were put into the heavy chemical industries to spur short-term economic growth. During China’s economic boom, the build-up of production capacity helped the development of real estate and infrastructure, which led to faster growth in these regions than other parts of the country. However, when the economy slowed down, the capacity suddenly became redundant. And since there’s a lack of diversity in the local economy in those three provinces, economic growth dropped faster in those regions (see Chart 2).

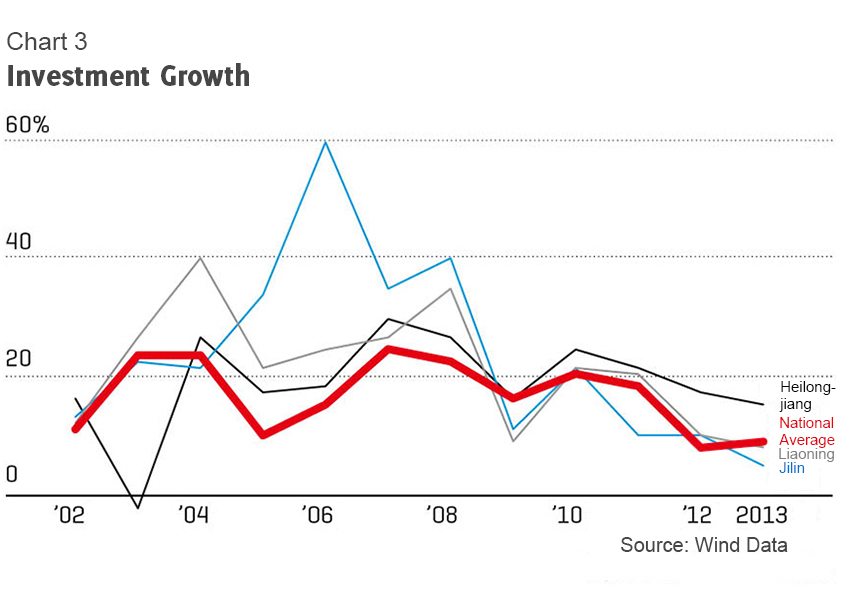

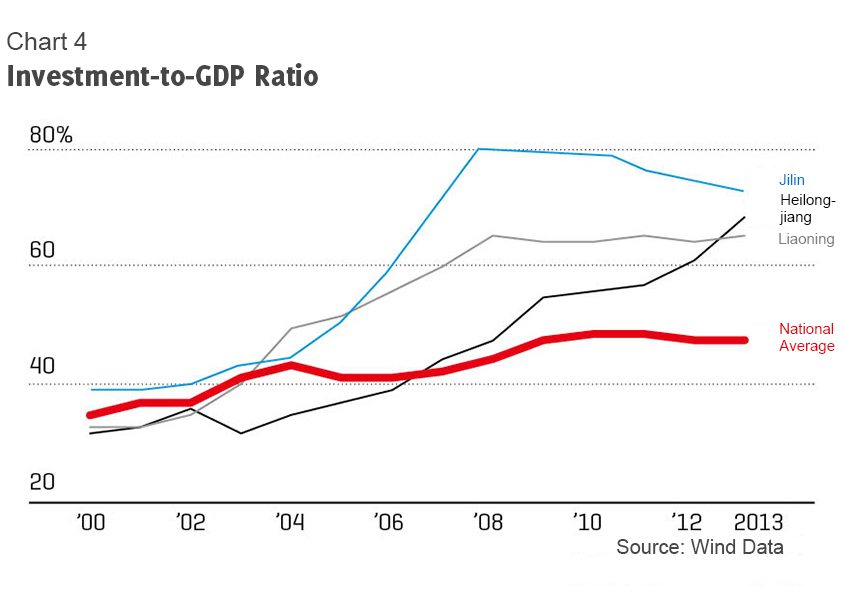

And it’s obvious that economic growth in those three provinces was faster than the national average before 2014, and the growth was mostly driven by investments (see Chart 3). And the investment-to-GDP ratio (see Chart 4) was even higher—in 2000, the ratio was about the national average level, but it started rising sharply since then. In 2008, the ratio of Jilin reached as high as 80%.

What has led to the serious overcapacity problem in China is the country’s economic growth model. The Chinese government still has a lot of control over the economy. Despite that, it has said that the market should become the decisive force in the economy. A popular analogy is that with its visible feet the government has stepped on the invisible hands of the market.

For local officials, in order to achieve faster growth, which is very important to their political careers, they are keen on building up big projects in the heavy chemical industries. They care less about how those projects will influence the economic structure of the region and if they will make financial returns in the future. Therefore, many projects were destined to make losses from the very beginning, which damaged the future growth of the local economy.

If the market force really comes into play, then there are two scenarios for those companies with severe overcapacity: one is bankruptcy, and the other is being taken over by more efficient firms. But from the perspective of saving jobs, the government may be inclined to keep those firms alive, even though many of the employees are already furloughed. This creates a lot of “zombie firms”, which are desperately waiting for the market’s demand to pick up.

So in fact, the overcapacity problem is a reflection of the deep structural issues in the Chinese economy. To solve the problem, the mechanism must be changed, because it obviously wouldn’t go away on its own, and it could become even worse. Specifically speaking, China urgently need to adjust the relationships between the government, the market and the companies. The government’s power to distribute economic resources should be further limited, and state-owned companies should only exist in a few industries that are the most crucial to the foundation of the economy.

What would lead China’s economic growth is more efficient private businesses. It’s the only way for China to avoid the overcapacity trap and achieve sustainable and inclusive growth.