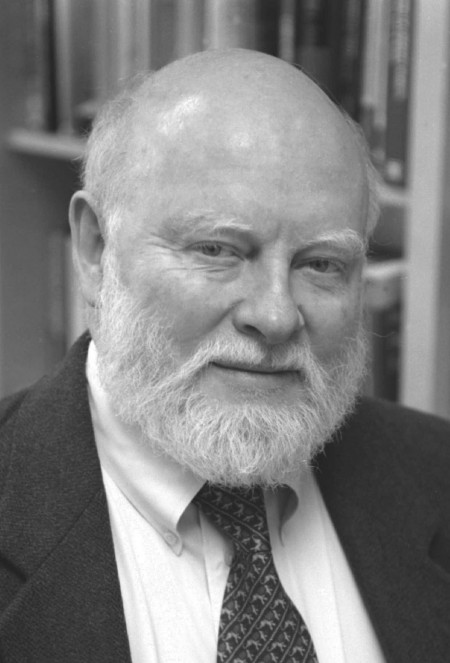

For the past half-century, the dollar’s status as the de facto unit of international currency has, despite periodic protests from major countries, continued unabated. However, the combination of America’s relative economic decline and the recent political impasse in Washington has pushed China, America’s largest foreign debt holder, to challenge the dollar’s privileged status in world trade. From the US’ perspective, the larger issue facing international trade is that of the ‘undervalued’ RMB, with certain members from both ends of the political spectrum attributing the artificially depreciated RMB as the primary cause of the US’ trade deficit with China. Ronald I. McKinnon, Professor Emeritus of International Economics at Stanford University, weighs in on these contemporary power dynamics from the perspective of the dollar standard in his latest book The Unloved Dollar Standard: From Bretton Woods to the Rise of China.

Following two decades of continuous research on China and America’s monetary policies, this book represents McKinnon latest contribution to the field of international finance. McKinnon first visited China in 1992 at the turn of China’s economic rise. Intrigued by what he had witnessed, he made China the subject of his 1993 book The Order of Economic Liberalization: Financial Control in the Transition to a Market Economy based on the data provided by Chinese Finance Ministry.

Since then, McKinnon has returned to China many times to further research the country’s currency policy and its impact on international finance. In 1998, at one memorable summit, Premier Zhu Rongji proposed a question to McKinnon—“China has now accumulated $150 billion of foreign exchange reserves. What do you think is the right level?” McKinnon replied “(There)_is really no single correct number: the stock of exchange reserves is just a residual from your policy of pegging the RMB by buying dollars (at that time, at RMB 8.28/dollar).” His answer to that question would virtually remain the same today, even though the stock of official exchange reserve grew to about $3.6 trillion.

Acclaimed by his peers an “iconoclast who always challenge the conventional wisdom”, McKinnon’s refreshing views deviate from mainstream rhetoric and provide insights into the current state of international economy. In this interview, he draws lessons from history and argues against Washington’s China-bashing and a sudden appreciation of the RMB.

Q. As the title of your book indicates, you consider the dollar standard to be “unloved”. How did it emerge as a standard, and why has it persisted until this day as the norm in international commerce?

A. It really is a mere accident of history. After World War II, all the industrial world was flattened except the US. Every country was restricting its currency by exchange controls except the US. That was the beginning of the dollar standard where banks, firms and governments began to treat the dollar as the key currency for international transactions. The French initially protested, calling the dollar standard an “exorbitant privilege of the US” and demanding a true international currency. In response, the International Monetary Fund (IMF) in the late 1960s issued Special Drawing Rights (SDRs), which were essentially an amalgamation of the major currencies as a unit of account. However, the market paid no attention and SDRs failed to gain any traction.

Fast forward 30 years to 2008, and in the midst of the global financial crisis, governor Zhou Xiaochuan of People’s Bank of China, like the French, once again questioned the use of a single currency as a globalist reserve. In the G20 meeting that year, representatives from China prevailed on the IMF to present a viable alternative to the dollar standard, and the international organization in turn dusted off many more SDRs as its solution. However, this move has not gone beyond placating some political sensibilities.

Foreigners are not the only ones displeased with the dollar standard: the US Federal Reserve, in order to prevent conflict in rate-setting, assumes a passive position in the exchange-rate market. Void of its own exchange-rate policy, the US lacks the option to intervene to set the foreign currency price of the dollar. Here we are in 2013, the majority of the world still clears trade payments with the dollar, invoices primary commodities in the dollar, and holds foreign reserves in the dollar. The dollar standard has gone through all sorts of upheavals, but it is here to stay.

Q. You draw a parallel between Washington’s perception of Japan in the 1980s to that of the current Sino-US trade relations. What are some similarities between Japan then and China now?

A. The China-bashing rhetoric out of Washington sounds strikingly similar to Japan bashing more than three decades ago. From the 1980s to the mid-1990s, the US had a huge trade deficit with Japan. Washington thought Japan was cheating by keeping the Yen undervalued against the dollar, which would give them a mercantile advantage—cheaper exports translate to more exports.

History repeats itself. As China’s trade surplus with the US increases, so does the censure against China’s currency policy. Declaring a China a “currency manipulator”. Democratic Senator Charles Shumer of New York has been leading a continuous effort to instate a tariff as high as 27.5% on Chinese goods if China did not appreciate the RMB. In his 2008 presidential campaign, Republican candidate Mitt Romney repeated his intent on branding China as a currency manipulator and rebalancing Sino-US trade. All these are examples of “China-bashing” from Washington.

Q. Given the similarity in political language around Japan and China, what lessons can Washington draw from the era preceding Japan’s decades-long decline?

A. The bashing in neither case is right. Ultimately, the US has failed to recognize that the bilateral problem lies in the American saving deficiency (principally the American fiscal deficit which cases the trade deficit). When faced with the massive trade deficit with Japan, the US government exerted a lot of pressure on Tokyo to increase of the value of the Yen. Japan’s government succumbed and appreciated its currency. As a result, Japanese domestic capital investment slumped, a bubble was induced in stock and land prices that eventually burst in 1991. If Congress continues to misdiagnose the fundamental problem, which is the high American fiscal deficit and low personal saving, it is very easy to make the same mistake again. Fortunately, China has been much more resilient than Japan in resisting American pressure to appreciate its currency.

Q. The discussion of the yuan is often heated among the members of Congress in Washington. How do you separate a political response from an economic argument? In other words, when discussing these controversial bilateral issues, how much are arguments based on political rhetoric rather than on economic grounds?

A. I blame the economists first, not the politicians—the latter take advice from the former. More specifically, I blame the methodology economists employ when analyzing this situation. Central to most economists is the elasticities approach to the exchange rate impact on the trade balance. In this simplified economic model, the variables are the exchange rate, exports and imports. In this model, appreciating the exchange rate would make exports more expensive in foreign currencies so they would fall and imports appear cheaper in domestic currency so that they would rise. For a country like China, the elasticities model persuasively predicts that the country’s trade surplus should fall if the RMB is appreciated.

Unfortunately, this elasticities model has become obsolete except in textbooks. It is based on a bundle of insular assumptions that may have been valid when it was conceived in the 1930s through the 1950s when economies were less intricate: foreign trade was much more limited and capital flows were restricted.

Now in the new millennium, capital is highly mobile through multinational corporations and countries holding each other’s financial assets. In this more globalized world, domestic investment becomes highly sensitive to the exchange rate. If one country is forced to appreciate its currency, as Japan was, domestic investment will slump and reduce GDP growth so that imports slow along with exports. Japan’s trade surplus was not reduced even as stagnation sets in.

Q. With the recent US government shutdown and a shifting perception of the Congress’s ability to function effectively, do you think the dollar’s privileged position will change?

A. You would think it would! But recall the “Nixon Shock” initiated in 1971 by President Richard Nixon to force foreign countries to appreciate against the dollar. The sensitive market anticipated large dollar devaluation so that hot money outflows from the US pushed foreign central banks in the industrial world to intervene heavily to prevent their currencies from appreciating even more than Nixon wanted. Their resulting loss of monetary control then caused the “Great Inflation” of the 1970s. Upon observing the fiasco, the eminent economist Charles Kindleburger declared the end of the dollar era in 1974. Nevertheless the dollar standard persists to the present day even with zero interest rates on short-term US treasury bonds!

Coming back to the current debate, the desire to have a single international currency is understandable. Despite its numerous problems, it increases the efficiency of multilateral trade. Think about it like shopping in a grocery store: it is more convenient if everything is labeled in the same currency units and you can pay with this one money at the cashier. But in the world economy, whether or not this standard unit should be the dollar is an open question. While Congress might have put its debt ceiling problems on hold, they will come back next January. But it is extremely difficult to change the status quo. Thus, the dollar’s status as a reserve currency, albeit unloved, remains even if Washington continues to misbehave.

Q. In your book, you challenged the conventional belief that Washington needs to push to increase the value of RMB. In tackling this bilateral issue, what alternative do you offer?

A. Rather than increase the dollar value of the yuan, China should continue to keep the rate stable. With $3.6 trillion in foreign exchange reserves and its largely dollar-based trade, China has become a pillar of the dollar standard. A stable yuan-dollar facilitate world trade—particularly in Asia.

However, China and the US need to collaborate in order to fix different aspects of their respective economies and the right trade imbalance. China should work on increasing wages and corporate dividends, which would translate into higher household purchasing power and higher consumption to reduce its trade surplus. The US should do the reverse: raise taxes and reduce government spending so that private consumption is reduced along with its trade deficit. The combination could eliminate the trade imbalance all together.

But the US as the international money manager has a further role to play. The Federal Reserve should get the US out of its zero interest rate trap in the short-term and then back off from quantitative easing in the long-term. although advantageous to the US itself, moderately higher US interest rates would relieve the pressure from hot money inflows into China and other emerging markets—reducing financial repression in China where interest rates have had to kept too low because of Federal Reserve’s near-zero interest rate policies [For details of the distortions behind the currency Federal Reserve policies, refer to McKinnon’s column in The Wall Street Journal “The Near-Zero Interest Rate Trap”.]

By taking these aforementioned steps, the US and China can secure the exchange-rate and ameliorate their bilateral relationship. In other words, the US and China can and must work together to rehabilitate this unloved dollar standard.