Positive Trends

The BCI is directed by Li Wei, Professor of Economics at the Cheung Kong Graduate School of Business

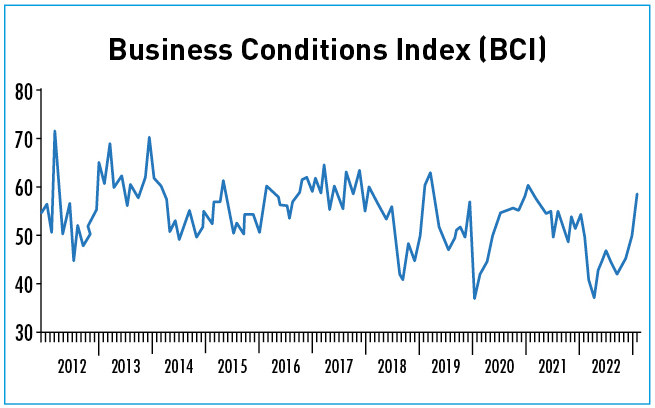

In February, the CKGSB Business Conditions Index (BCI) registered 57.6, a vast improvement from January’s score of 49.7. This month, apart from the company competitiveness index (which measures company positioning, not operational performance), all indicators rose, showing that China’s economic recovery is in process. The BCI is improving, and with this, the year’s economic outcomes should be something to look forward to.

Introduction

The CKGSB Business Conditions Index (CKBCI) is a set of forward-looking diffusion indicators. The index takes 50 as its threshold, so a value above 50 means that the variable that the index measures is expected to increase, while a value below 50 means that the variable is expected to fall. The CKGSB BCI uses the same methodology as the PMI index.

Key Findings

- • February saw an unusual rise in all four sub-indices

- • There was a 7.9 point rise in the main BCI index, a vast improvement on previous months

- • Much of the improvement can be accredited to the scrapping of zero-COVID policies and changes in real estate regulation

Analysis

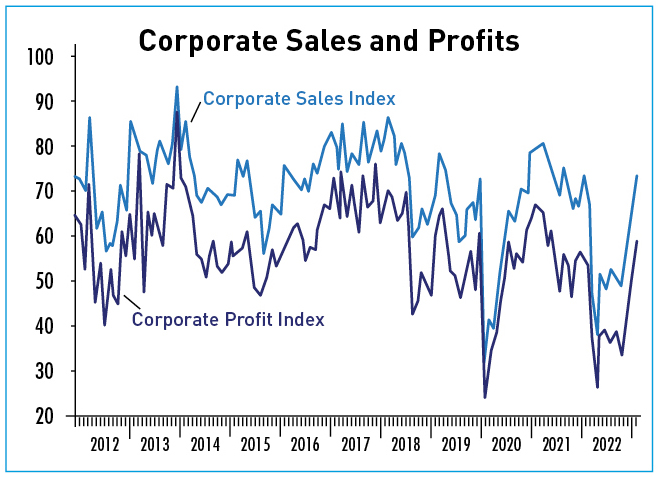

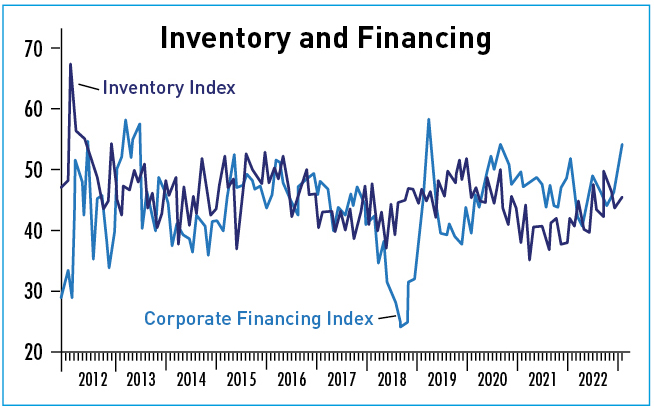

The BCI’s four sub-indices are corporate sales, profit, financing environment and inventory. Three of the four are forward-looking indexes, while the financing environment index measures the current situation.

The sales outlook rose sharply this month, from 59.9 last month to 73.1 this month. Profit prospects also registered a steep incline, landing at 58.7 this month compared with 45.9 last month.

The financing environment index lifted from 49.5 to 54.3 in February (Figure 4). Optimism regarding financing crossed the confidence threshold of 50.0. As for inventory, our survey respondents reported an improvement in warehousing that saw the index rise from 44.0 to 45.1, albeit remaining below the confidence mark, the only subindex to do so this month (Figure 5).

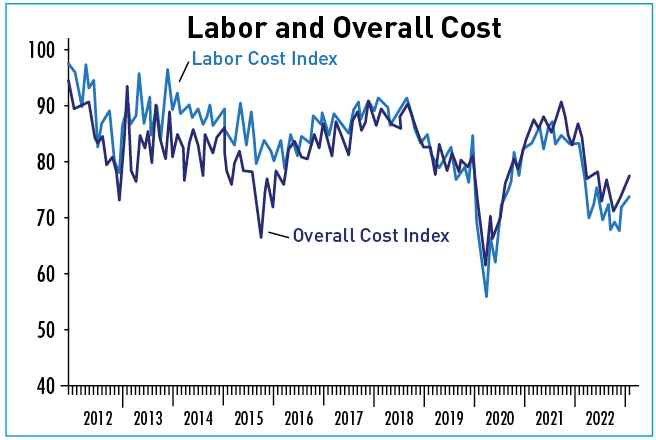

This month’s rise in labor cost expectations means that more companies believe they will be paying more to employ people in the next six months, a prediction that impacts business operations and is felt in overall cost calculations too. However, this could be a sign that as the economy picks up, companies have more demand for labor and expect costs to rise because of increased business activity.

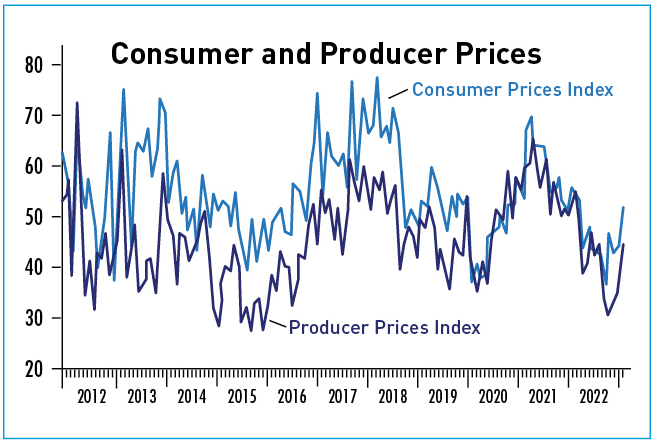

The index registering consumer prices rose significantly this month, from 44.0 last month to 51.7 (Figure 8). The index showing producer goods price expectations also rose sharply this month, from 34.4 last month to 44.2 (Figure 9).

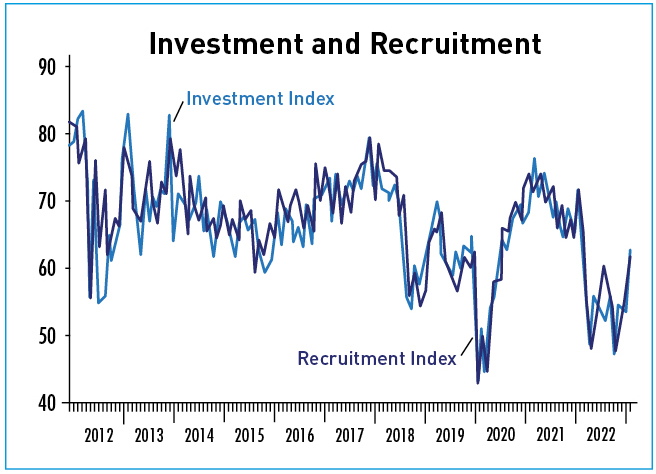

Investment and recruitment indices were high for a long time, but more recently sank into the doldrums. From this weak base, they both rose significantly in February, and since the Chinese economy is largely investment-driven, and investment is strongly tied to recruitment, this suggests that the Chinese economy is on the mend.

Conclusion

In February, all four sub-indices of the CKGSB BCI rose, something that has rarely happened in the 12 years in which we have conducted our monthly study. Many of the indicators, including the main index, have risen sharply. If the recovery goes on like this, China’s economic results this year will be worth the wait.

Why have the BCI and similar indices shown such a big improvement in such a short period of time? The author agrees with most commentators that at the bottom of this seemingly remarkable economic recovery lie two factors: the dropping of Zero-COVID rules, and changes in real estate-related policies.

The rapid recovery of China’s economy reflects its resilience, but we still have to confront structural problems that are in need of urgent resolution.