Baidu, Alibaba, Tencent and Xiaomi are busy investing in other companies to supplement their core business—and outdo each other.

China’s internet world is ruled by three big players: Baidu, Alibaba and Tencent, collectively known as BAT. All three have their unique strengths. Baidu is the undisputed king of the search market; Tencent, the company behind the wildly popular WeChat, is the dominant player in social media; and Alibaba is the biggest e-commerce player. The three companies generated revenues of $20 billion in 2013 and $8.16 billion in the third quarter of 2014. To understand how popular they are, sample this: according to a study released by Baidu in 2014 to track what the Chinese did on their mobile phones, it was found that almost 60% of time spent on a mobile device in China is spent on an app affiliated with Baidu, Tencent or Alibaba.

It is clear that the big three account for a significant, and perhaps disproportionate, share of China’s internet market. Another technology company that has risen to prominence pretty quickly is Xiaomi. While its core competence is mobile phones, Xiaomi is fast making inroads into new areas, as varied as wearable technology and personal transportation.

Many of the things you are accustomed to using in your everyday life might just have a BAT or Xiaomi connection. For example, Segway, the famous electric self-balancing scooter, is now owned by its Chinese rival Ninebot, a company partly owned by Xiaomi. Six months after the deal, the company officially launched the Ninebot Mini, which at its ridiculously low price point of RMB 1,999 (approx. $310) has the potential to disrupt the market. Misfit, the maker of fitness bands, is now backed by Xiaomi even though the company has its own fitness bands. Additionally, in 2014, Xiaomi took a 1.29% stake in Chinese white good manufacturer Midea for the sum of $199.6 million. The strategic partnership demonstrates Xiaomi’s determination to enter the smart home domain—their first joint product, a smart air-conditioner, is now in stock in Midea’s flagship shop on Tmall.

Baidu, which is often called the Google of China, has its fingers in many pies. The company now has a heavy emphasis on O2O, or Online to Offline, which seems to be guiding its investment decisions. Baidu CEO Robin Li recently told the media that O2O will be Baidu’s next priority, even bigger than its core search engine business. In 2014, Baidu acquired Chinese group buying service provider Nuomi. More recently, Uber China confirmed that it had raised $1.2 billion in an investment round that included Baidu. Baidu has also invested $100 million in the popular Chinese O2O laundry app, eDaixi.

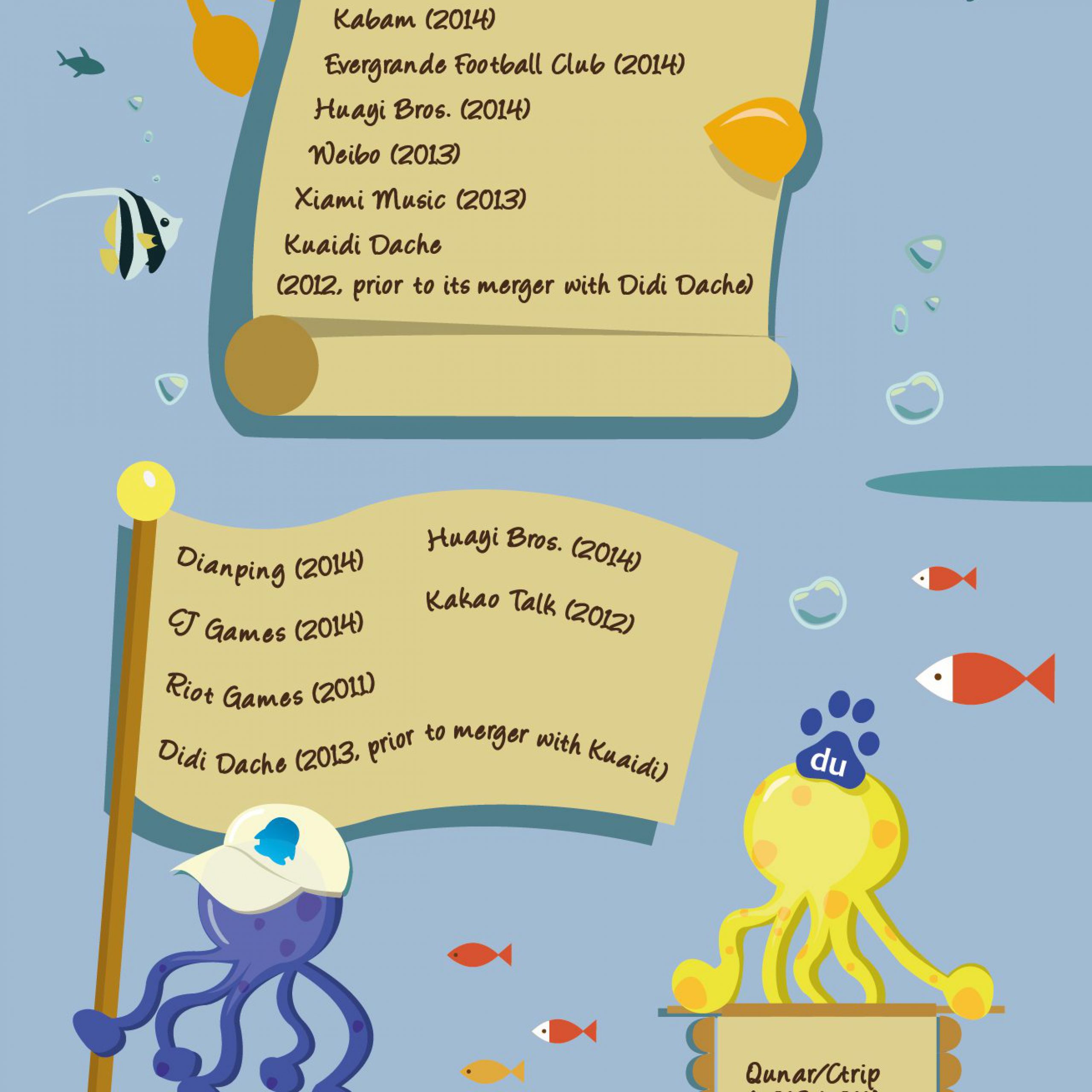

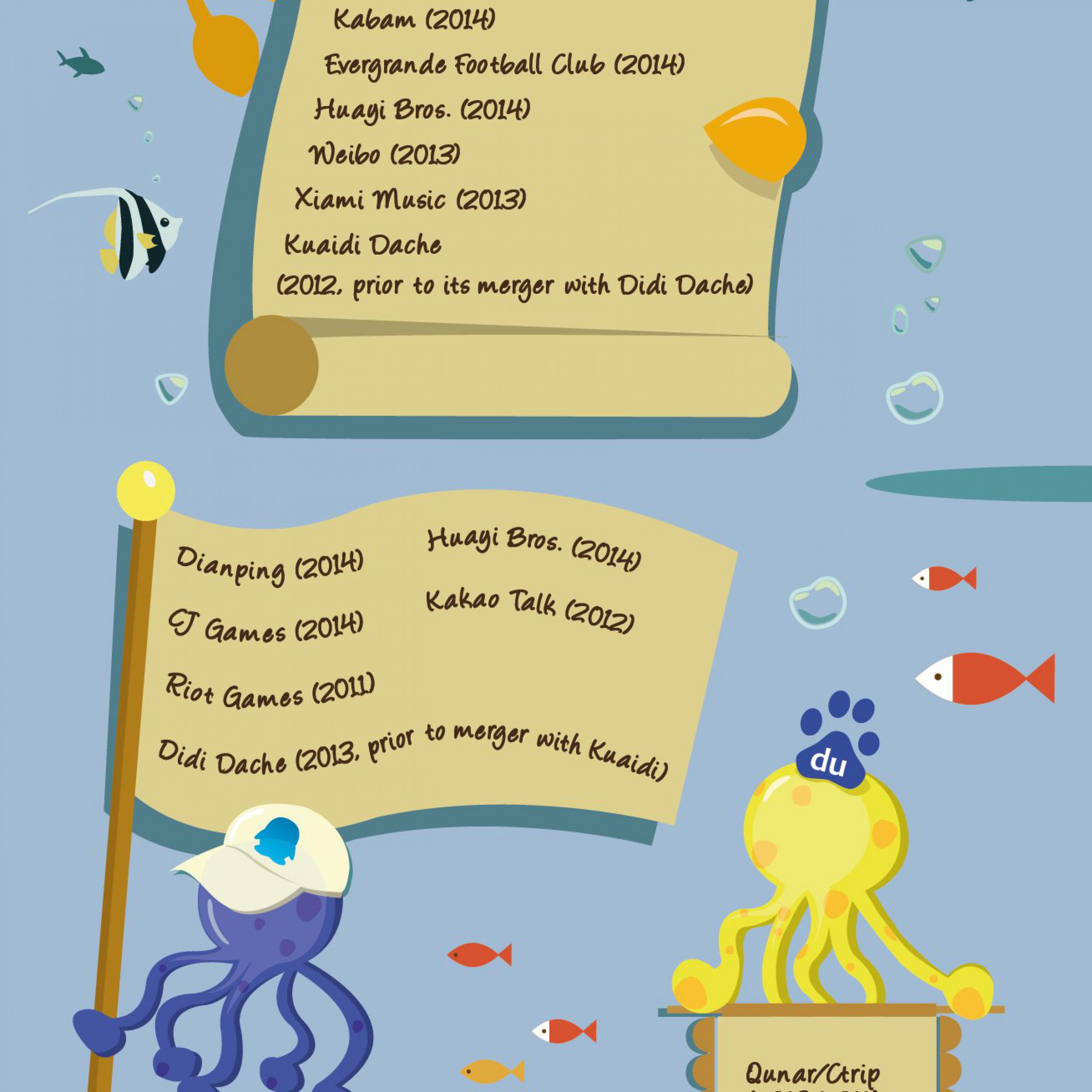

Tencent, for most part, appears to be sticking to its core strengths of gaming and social media even as it goes ahead and invests in companies. The company, which ranks as the world’s most profitable iOS game publisher according to data from App Annie, splashed $231 million to buy Riot Games, the developer of hit game League of Legends, in 2011. Then in 2014, it spent another $500 million for a 28% stake in Korean game developer, CJ Games. In 2012, it invested $80 million to buy 13.8% of Korean instant messaging app Kakao Talk’s shares.

It is worth mentioning that Tencent made a big-ticket investment in taxi hailing app Didi Dache in 2013, and another one in 2014-end. Didi’s arch rival, Kuaidi Dache on the other hand, is backed by Alibaba. For several months, Didi Dache and Kuaidi Dache engaged in a serious price war in a bid to outdo each other. Obviously, in the background, this was the Alibaba-Tencent rivalry playing it. But what happened next came as a shock: on Valentine’s Day this year Didi Dache and Kuaidi Dache merged into one $6 billion company. Although the newly formed Didi Kuaidi takes the co-CEO approach, it’s rumored that Didi’s team is in the driver’s seat.

Alibaba has been a little eclectic in its investment choices. While some investments are aligned with its business model (such as electronics retailer Suning) and diversification plans (such as film production company Huayi Brothers and online video site Youku Tudou), others seem a bit bizarre. In 2014, Alibaba spent RMB 1.2 billion (approx. $192 million) for a 50% stake in Chinese football club Guangzhou Evergrande. When asked about the logic behind, Alibaba Chairman Jack Ma quite honestly said that he didn’t know much about football. “I invested in Evergrande with no interest in winning or losing the games, but to kick the door open and see what’s really going on with Chinese football.” He also said he felt that the Chinese people attach way too much importance to the result. “The most important thing,” he said, “is to have fun.”

Want to see which brands and companies are backed by BAT or Xiaomi? Click on the infographic below.