China’s hospitals are becoming overstretched as population aging and urbanization send demand for health care soaring. But a new wave of world-leading Chinese health technology companies believe they can lift the burden on the country’s frazzled doctors

Chinese medical centers tend to be crowded, chaotic places, but the radiology department of the Shanghai Ninth People’s Hospital is an oasis of quiet. The only sound in the dimly-lit office is the rapid clicking of computer mice.

At one of the terminals lining the room, Dr. Wang Meili* is analyzing CT scans of a patient’s lungs. It is easy to see why the young radiologist has little time for chit-chat. There are 150 sets of scans waiting for her to examine—around 30,000 images.

“Each doctor in our team reads at least 20,000 images per day,” Dr. Wang tells CKGSB Knowledge. “The work is intense. Radiologists in a similar position in the United States have a workload about one-third to one-half of ours.”

Luckily for Wang and her colleagues, they have a secret weapon to help manage their huge in-tray. On the black pair of lungs in the center of Wang’s screen, several small dots have already been circled in white. To the right, a short report outlines what these suspicious nodules might be.

All this work has been completed by Care.ai, an artificial intelligence-driven diagnosis system developed by the Chinese startup Yitu Technology. The system can analyze a patient’s scans, flag issues and write up a report in just a few seconds, work that takes a human physician between five and 10 minutes on average.

“Care.ai has greatly reduced the pressure on our doctors,” says Dr. Wang. “It’s also helping reduce misdiagnosis and missed diagnosis rates due to fatigue and stress. And it provides more information than we had previously—for example, by automatically comparing the scans with a patient’s historical records.”

Yitu’s system sits at the crest of a technological wave sweeping through China’s health sector. Health tech will be a $150 billion market in China by 2020, according to estimates by research firm Bernstein. The Chinese government is actively driving this revolution as it sees technology as the best way to help an already overstretched health care system cope with an explosion in demand.

“Compared to governments elsewhere, China has the friendliest attitude toward the AI health care market,” says Cathy Fang, Vice President at Yitu Healthcare. “Several government departments have special projects to support the development of the industry.”

This support is propelling Chinese companies like Yitu to the forefront of one of the world’s most important emerging industries.

Health Issues

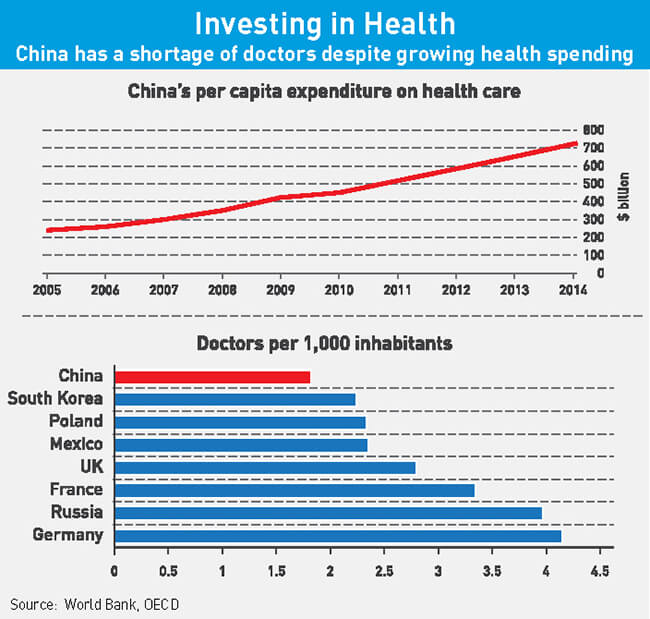

It is easy to understand why China is pushing health technology when you visit a public hospital in Shanghai or Beijing. China’s health care expenditure has risen faster than gross domestic product over the past decade, but the strain on medical centers is still clear.

“In a Chinese public hospital, typically you get 5-10 minutes with a doctor, maximum,” says Simon MacKinnon, co-founder of China health care consultancy and investment firm Sinophi Healthcare. “A doctor is seeing 100-150 patients a day. It’s extraordinary.”

The reason is a chronic lack of qualified doctors. An often-cited figure is that China has around 1.5 doctors per 1,000 people, just over half the number in the United States. But a more telling statistic is that fewer than half of China’s doctors have a university-level education, according to China’s National Health and Family Planning Commission.

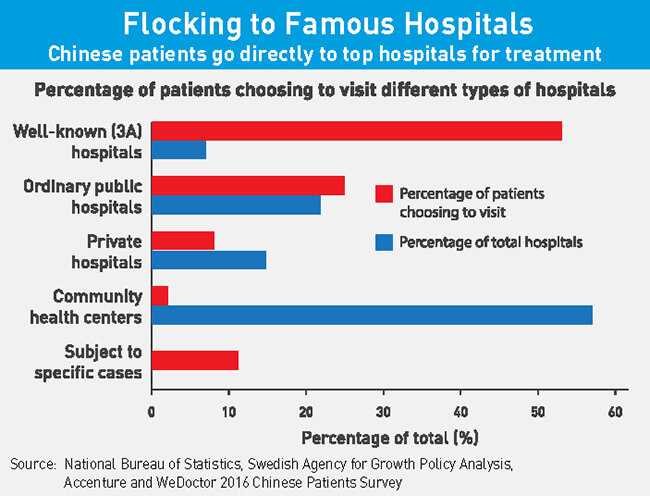

The best doctors are concentrated in the top hospitals in the major cities, and so patients flock to these institutions. Chinese hospitals with a “triple-A” rating, the highest level available, make up 7.7% of the country’s medical centers, but handled half of total outpatient visits in 2016, according to the South China Morning Post.

“If patients are in Jiangsu Province and worry they have a serious illness, they’ll go to the best hospital in [the provincial capital] Nanjing,” says MacKinnon. “If Nanjing is still not good enough, then they’ll come to Shanghai. The higher up the pyramid you go, the more pressure there is on resources.”

The overcrowding of major hospitals often causes tension between patients and doctors. One-fifth of China’s doctors have been assaulted by a patient and four-fifths have been verbally abused, according to a survey by Chinese research firm Yimi Research.

The widespread reporting of these incidents deters talented students from joining the medical profession, making the recruitment of more doctors even more difficult. In a 2016 survey of China’s top high-school graduates, not a single student said they wanted to pursue medicine.

“If I have kids, I’m not sure I’d encourage them to become doctors,” says Yuan Jiasheng, a teacher from Jiangsu Province. “It’s kind of a dangerous profession.”

But new doctors are urgently needed because of the skyrocketing demand for health care. This rise in patient numbers is being driven by a perfect storm of demographic factors.

“You’ve got three enormous drivers,” explains MacKinnon. “People are becoming better off—as you get wealthier, you tend to spend more on health care for you and your family. Second, you’ve got rapid population aging. And third, you have urbanization—when you move to the suburbs, you’re more likely to have access to health care.”

The number of people aged 60+ in China is set to soar 90% to 240 million by 2020, according to the World Health Organization. This, along with the increasingly unhealthy lifestyles of urban Chinese, is leading to a rapid rise in the prevalence of chronic diseases such as diabetes and cancer.

The Shanghai Ninth People’s Hospital is already struggling to cope with the growing number of patients. “China’s aging society and increase in chronic diseases pose enormous challenges for the entire medical system,” says Dr. Wang. “In the imaging field alone, the annual growth rate of data in China is over 30%, while the number of imaging physicians is only increasing 4% per year.”

Turning to Technology

As a result, technology companies are finding massive demand among Chinese hospitals for products that help them become more efficient, according to Efstratios Tsougenis, a director at Hong Kong-based medical imaging startup Imsight. “There is no other possible solution for the hospitals,” says Tsougenis. “You cannot train doctors in two years; it takes 10 years to train an expert. So, demand for health tech will grow exponentially.”

The Chinese government is also promoting the integration of new technologies into the health care system through policies such as its Internet Plus Health Care strategy, which Premier Li Keqiang has championed. The policies focus on reducing the administrative burden by digitalizing patients’ medical records and allowing patients to book appointments and order drugs online.

Online health platforms such as WeDoctor—a startup backed by Chinese tech giant Tencent, valued at an estimated $5.5 billion—have flourished. WeDoctor now connects over 20 million patients with 220,000 doctors at 2,700 hospitals.

The online booking systems offered by WeDoctor and its competitors have reduced waiting times significantly, according to MacKinnon. “At Chinese hospitals, it used to be like the Harrods sale at 6.30 a.m. every day of the week,” he recalls, referring to the huge lines of patients waiting for an appointment.

“Now, instead of wasting a whole morning on a simple checkup, at some hospitals you can book a time using an app and be in and out in under an hour.”

Another area with potential is solutions that help patients self-diagnose and manage chronic diseases like diabetes without needing to visit a hospital. There are 109 million diabetics in China and hundreds of millions more are estimated to be at risk of developing the disease. Both Chinese and foreign companies are racing to roll out systems integrating wearable devices that help diabetics track their condition and chat bots that can help diagnose a patient’s symptoms remotely.

“In China, you’ve already got a massive takeup of technology in the pre-primary and primary care area,” says MacKinnon. “We’re seeing so much change and it is young people that are the rapid adopters.”

But the benefits for hospitals are likely to remain minor in the short term because of the low level of health education among many social groups in China, according to Douglas Corley, CEO of health tech consulting firm DHB Global.

“For diabetes, there’s a lack of understanding of the disease and that you have to keep checking your blood sugar level,” says Corley. “In the US, the compliance rates are about 60%; in China, they’re about 20%.”

Rise of AI

However, companies that are integrating artificial intelligence systems into doctors’ clinical work, like Yitu, are already bringing visible benefits to the Chinese health system.

The AI health care field has developed incredibly fast in China. There are already 131 companies working in this space, according to consulting firm Yiou Intelligence, and these startups received $2.7 billion in funding during the first half of 2017 alone.

Most of China’s AI health care companies currently focus on medical imaging systems that help doctors analyze X-rays, CT scans and tissue analyses for signs of dozens of diseases, from cancers to liver disease. Doctors at Chinese hospitals train the AI systems and the accuracy of the diagnoses now rival that of the country’s top human doctors, according to Yitu. This puts Chinese companies at the cutting edge of the field.

“The diagnostic rates for these AI algorithms in China are very, very high,” agrees Corley. “It compares favorably with almost anywhere in the world.”

In some cases, the algorithms are even improving the quality of diagnoses because they are being trained using clinical data taken from local populations.

“Previously doctors manually compared a Chinese child’s bone age to a standard that was developed 40 years ago based on a white population, so it does not accurately reflect the growth or development of Chinese children,” says Yitu’s Fang. “We are generating the first growth and development curve for Chinese children.”

The key to the Chinese startups’ success is the speed at which they have partnered with hospitals and started feeding data into their systems at huge volumes. “As you’re creating these neural networks you need one thing, and that’s data,” explains Corley. “You can’t compete with China on health data.”

Chinese companies can access data easily not only due to China’s large population, but because Beijing is encouraging medical centers to collaborate with AI startups, according to Imsight’s Tsougenis. He adds that his company already has partnerships with more than 100 Chinese hospitals.

As a result, companies like Yitu have leapfrogged many peers in the US, where much of the base technology for machine learning systems was developed. “In America, I know several companies that started in AI health care in 2013-2014, but when I spoke to them last year their products were still pretty much the same as when I first saw them,” says Yitu’s Fang.

“The main reason is that they struggle to annotate the training data. For them, a thousand data points is a big thing, but for us 10,000 is a starting point.”

At the moment, AI imaging systems are mainly used as efficiency tools and a second pair of eyes by doctors in urban hospitals, but they could do much more. According to Corley, Beijing is keen to use AI solutions to help mitigate the gaping disparity in health care provision between urban and rural areas. AI bots could be used to evaluate X-rays from rural patients and even train rural doctors.

“AI for diagnostics is a win for everybody,” he says. “It allows rural doctors to receive training and have better outcomes, it saves the hospitals money and it saves patients time and money.”

Robots are not likely to replace human doctors any time soon, says Fang, but this could be a possibility down the line. “I don’t think that AI is going to replace doctors, at least for the next 5-10 years,” she says. “Our technology currently is suitable only to replace repetitive, tedious and specialized tasks.”

Scanning for Opportunities

It is impossible to say how large the market for AI health care could become in revenue terms, but Yitu believes that its health care business will eventually be even more lucrative than surveillance, a market that has already produced four companies worth over $1 billion in China.

“I believe that health care will be the number one application field for AI in China,” agrees Tsougenis.

Yitu is also exploring opportunities to export its technology. However, it could be held back by the same problem that US companies have when trying to enter the Chinese market: a product developed for Chinese patients may not be effective for diagnosing Westerners, and vice versa.

“We are launching our products in Singapore and Hong Kong to test the waters of the international market because there the genetic background of the population is similar to the Chinese mainland,” says Fang. “But for the US market, we are focusing on research collaboration.”

The Americans and Chinese are often thought of as competitors in the field of AI, but Fang believes that in health care the two sides’ strengths complement each other perfectly.

“The strength of the US is cutting-edge research capability—they are far ahead in terms of exploring the limits of AI,” says Fang. “China’s strength is its rich clinical resources. Even if you want to develop AI products on very rare conditions, you can do that in China.”

Yitu plans to put that theory to the test with a partnership with Harvard Medical School. Both sides have clear incentives to work together. All of the world’s major economies are facing the same health issues as China.

“The whole health care system is unaffordable on a 10-15-year outlook—and that’s true all over the world,” says MacKinnon. “It has to change, and technology has to be the enabler.”