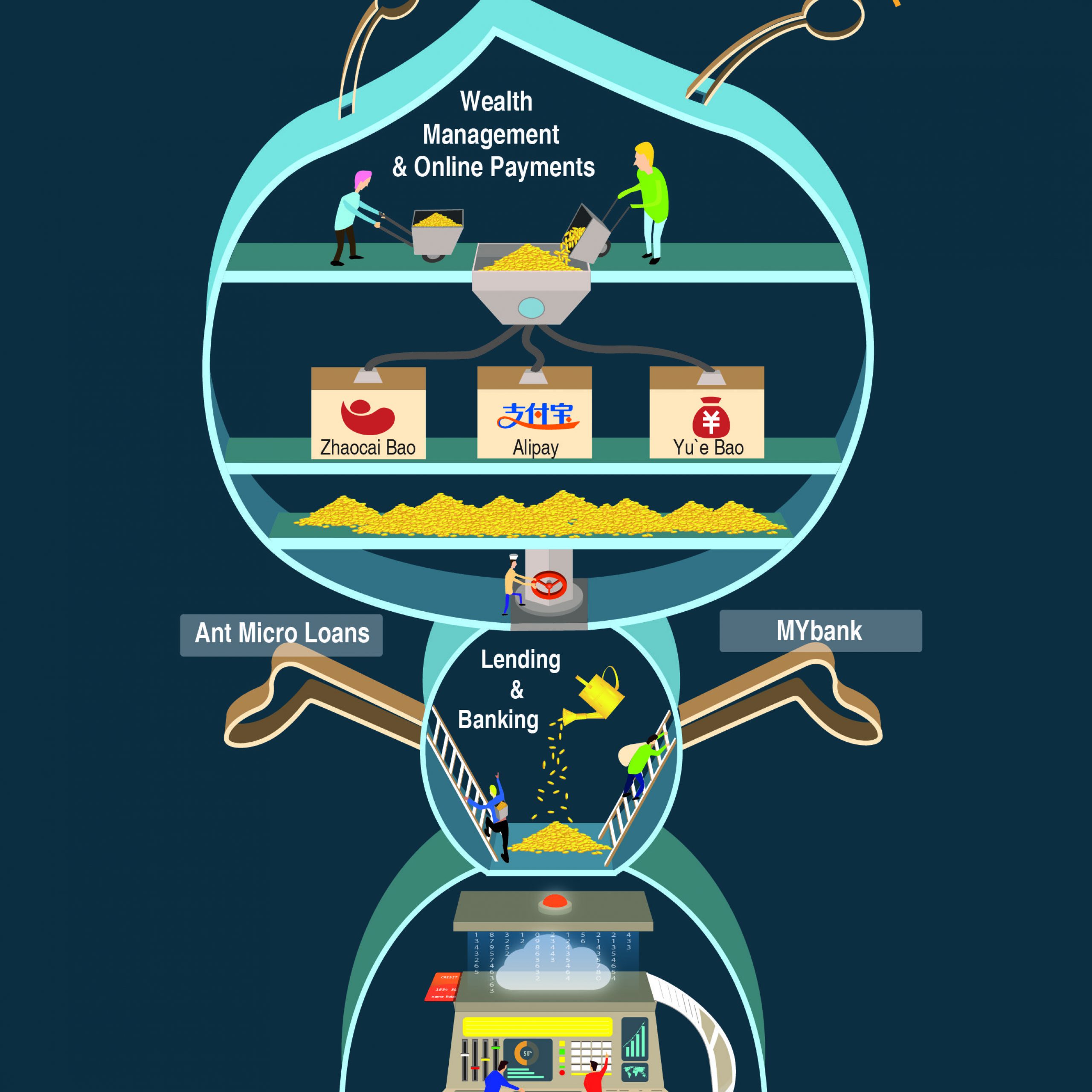

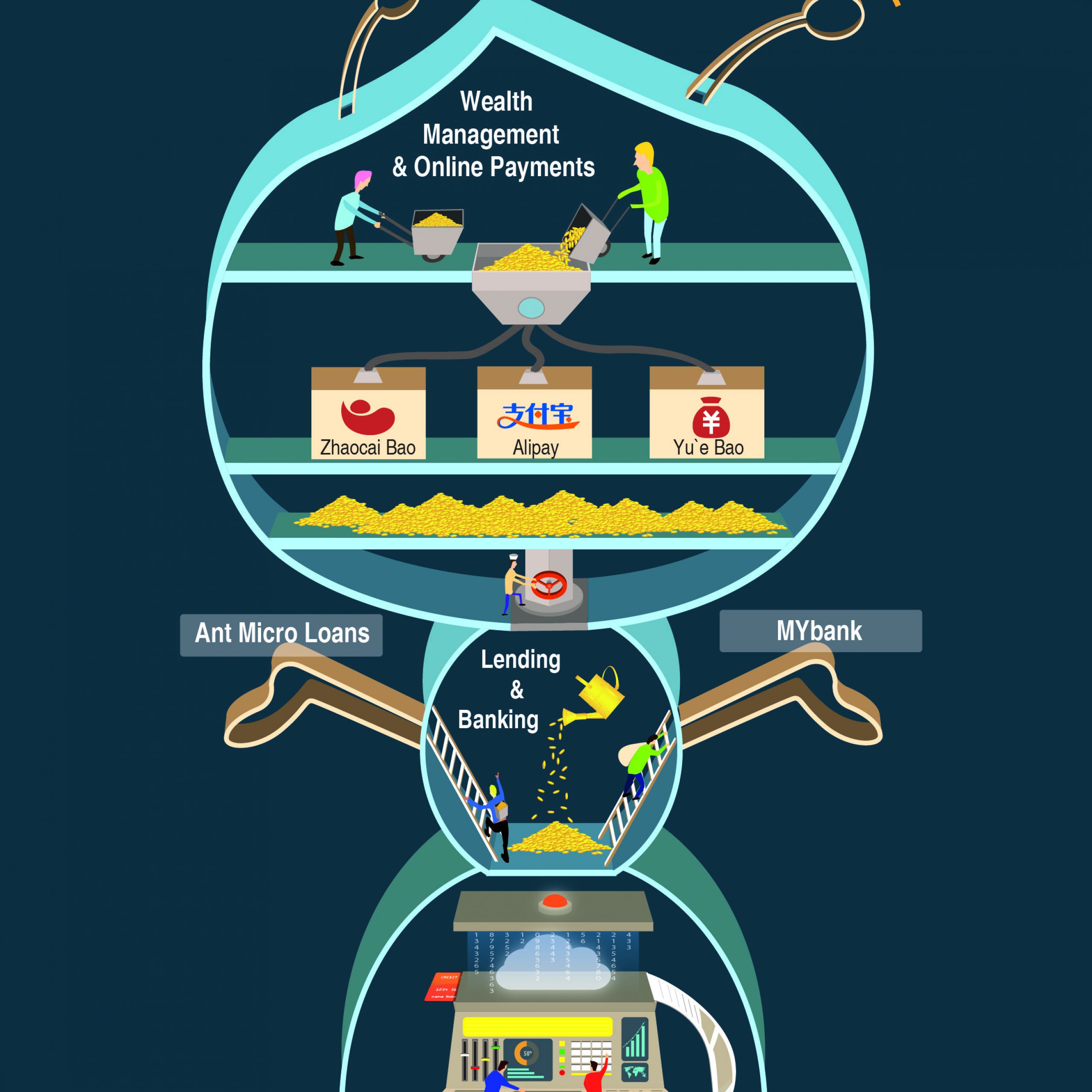

In a short space of time Alibaba’s Ant Financial Services Group has created—and scaled—a diverse set of financial products and services: from online payments to cloud computing and data services.

Ever since Alipay, China’s most used online payment platform, was transferred away from the Alibaba Group in 2011, it has grown into a billion-dollar company that has a finger in almost every pie in China’s booming internet finance industry.

Renamed Ant Financial Services Group late last year, the company has grown beyond just online payments to services like microlending, banking, credit scores, etc. (Alipay, the original online payment service, is now one part of the larger Ant Financial.)

The company just finished its first round of financing in July, reportedly raising more than RMB 10 billion ($160 million) on a valuation as high as RMB 310 billion ($50 billion). What’s more eye-catching than the numbers is the lineup of leading investors—it includes a group of state-backed insurance companies as well as the country’s National Social Security Fund (NSSF). It’s the first time that the NSSF, which manages about RMB 1.2 trillion in assets, has directly invested in a private company in China, according to the fund’s website. Ant Financial sold 5% of its shares to the NSSF “at a significant discount”, Caixin reported.

But the company’s ambitions go far beyond a high valuation, said Jing Xiandong, President of Ant Financial, told the Chinese press at various occasions. According to Jing, Ant Financial’s goal is to build a new and truly inclusive financial system on the internet that better serves small businesses and the public.

So what is Ant Financial all about? What kind of products and services does it offer?

Alipay and Yu’e Bao

As far-reaching as the company’s aspiration is, Ant Financial certainly has a solid foundation to start from. Its flagship product Alipay controls more than 82% of China’s online payment market, according to iResearch, a consulting firm. With more than 400 million real-name users, the platform now processes on average 120 million transactions per day, according to Caixin. In comparison, data from People’s Bank of China shows that in 2014, the country’s banking system handled about 170 million non-cash transactions on average every day (this includes bills, bank cards and all electronic transfers).

Alipay’s popularity has fueled the rapid rise of internet finance products developed (or co-developed) by Ant Financial, the most notable being Yu’e Bao, a money market fund that offers higher interest rates than banks (while Yu’e Bao’s interest rates have dropped in recent months due to Beijing’s easing measures but remain about 40% higher than banks). Sold through the Alipay Wallet app, the fund raised more money than any other mutual funds in China in just seven months (the fund currently stands at about RMB 668 billion, or $108 billion). Zhaocai Bao, a peer-to-peer lending platform that’s also embedded in Alipay Wallet, has more than RMB 200 billion ($32 billion) in total transactions since its establishment last April.

Small Business Loans

Compared with the rockstar status of these consumer-facing brands, Ant Financial’s small business loans unit is less known. The firm lends out small loans under RMB 1 million ($160,000) to credit-starved businesses left out in the cold by China’s banking system, which oftentimes favors bigger companies and state-owned enterprises. According to its website, the firm had lent out more than RMB 190 billion ($31 billion) in total by March 2014.

And Ant Financial is expanding its lending business through its 30% stake in Zhejiang Internet Commerce Bank (or MYbank), a joint venture between a group of private firms, including one controlled by Guo Guangchang, Chairman of Fosun International, arguably China’s largest privately-owned diversified conglomerate. The bank, which secured its license last year and had a soft opening in June, has no physical branches; it can issue loans under RMB 5 million ($810,000) to small businesses as well as individual customers.

Data and Credit

The backbone of Ant Financial’s system, which involves payment, wealth management, lending and other services, is the group’s data resources. With Alipay and other products, Ant Financial is able to keep a finger on the pulse of each and every customer—their shopping history, utility bills, work and home addresses, contact information and even properties they own and families they have. So if someone bought a crib, they most likely have a baby at home. Based on all this information, Ant Financial can establish accurate credit profiles of customers, based on which it may carry out a variety of credit-related services.

Sesame Credit, a subsidiary of Ant Financial, is among eight private firms that are expected to receive credit service licenses very soon. According to its website, Sesame Credit scores range from 350 to 950, and the company’s goal is to help create a full credit system, in which discredited people “can’t move an inch”.

Financial Software and the Cloud

Besides data, Ant Financial is building up its strengths in the financial software business. Last year, Alibaba Chairman Jack Ma and his business partner Xie Shihuang acquired the Hudson Group, which owns a controlling stake in Hudson Technologies, a public traded financial software developer. In early June, Ma and Xie transferred their ownership to Ant Financial, which became the new controlling shareholder of Hudson Technologies since then. The software developer, which raked in more than RMB 1.4 billion ($230 million) in revenue last year, has a wide range of customers including trusts, securities brokerages and private equity funds, among others.

Ant Financial also has a cloud-computing unit called Ant Financial Cloud, which it claims is capable of building entire IT frameworks for financial institutions like banks and mutual funds. For example, unlike Tencent’s private bank (WeBank), whose system is built upon infrastructure used by traditional brick-and-mortar banks, MYbank’s system is going to be completely based on the Financial Cloud. While this market is still dominated by international giants like IBM, Oracle and EMC, more opportunities may emerge for domestic players like Ant Financial as Beijing tries to push forward the localization of financial IT solutions for national security concerns.

Although the group hasn’t elaborated on its plan to go public, Shanghai Securities News reported in February that a leaked document from Ant Financial showed that it plans to list in Shanghai in 2017. It’s possible that the group will have more rounds of fund-raising before that happens, and Jack Ma, who still owns a sizable share of Ant Financial (could be close to 50%), is reportedly going to dilute his stake to about 7% eventually.