test

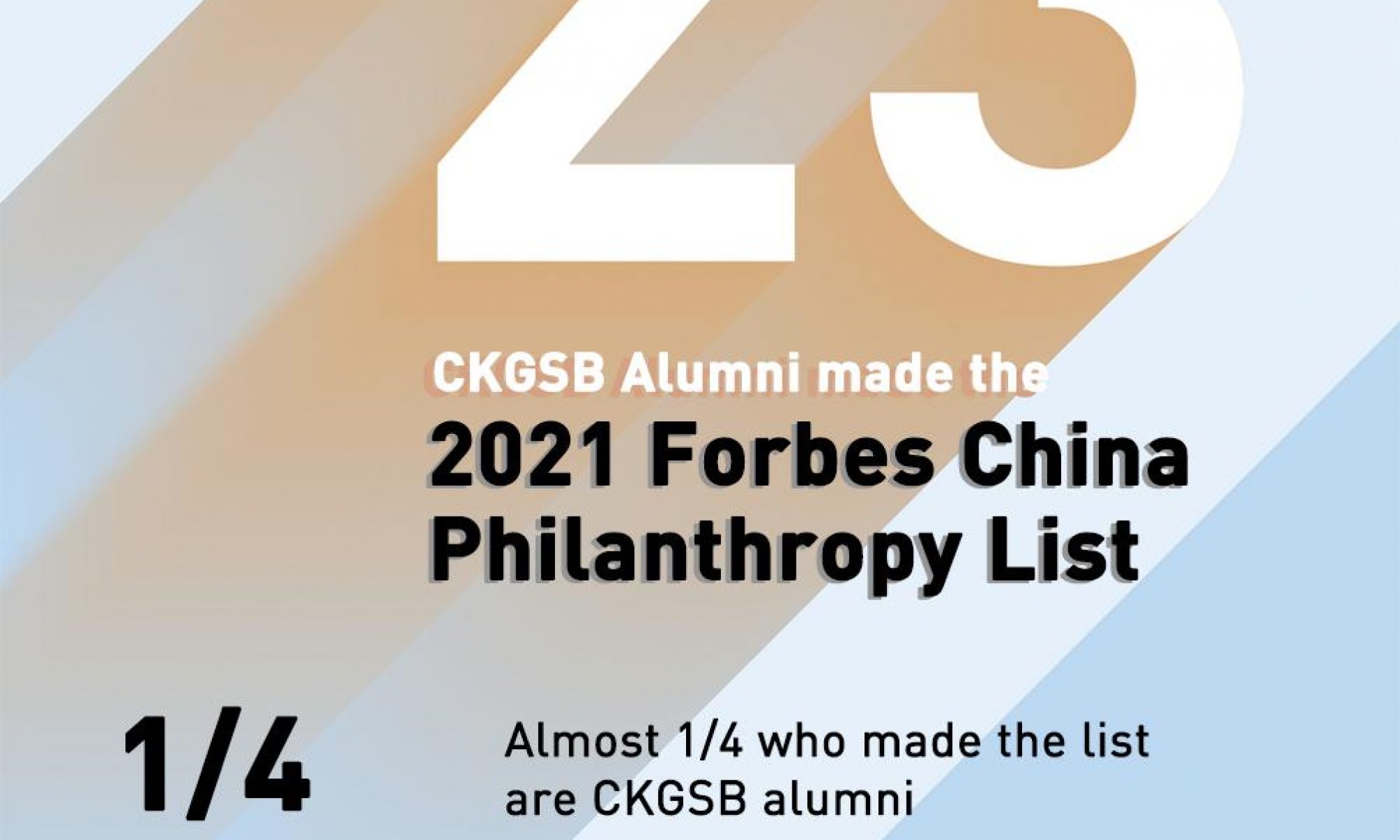

23 CKGSB Alumni Named on 2021 Forbes China Philanthropy List

In the recent 2021 Forbes China Philanthropy List, 23 of the 100 top Chinese entrepreneurs who had made the most contributions to public welfare were CKGSB alumni. Compiled based on cash donations of individual and corporate donors in China during 2020, this year’s list represents 221.7 billion RMB (approx. US $34.21 billion)cash donations made to charity, in which CKGSB 23 alumni’s contributions of 63 billion RMB (approx. US $9.72 billion) make up 30% of the total amount.

In addition to the Philanthropy List, CKGSB alumni also had a prominent presence in other lists that Forbes China recently released, amplifying CKGSB’s positioning as the preferred choice for business leaders:

- 2021 Forbes China’s 50 Best CEO: 7 CKGSB alumni listed

- 2021 Forbes China’s 100 Top Businesswomen: 11 CKGSB alumni listed

- 2021 Forbes China’s 50 Women in Tech: 2 CKGSB alumni listed

- 2021 Forbes China’s 20 Up-and-coming Businesswomen: 1 CKGSB alumni listed

- 2021 Forbes China’s 100 Most Innovative Companies: 6 CKGSB alumni companies were listed

Since its establishment in 2002, philanthropy has been part of CKGSB’s DNA and core responsibility. CKGSB’s vision is to influence the Chinese business community in addressing society’s most challenging problems and sharing best practices in social innovation from China with the world. We are proud of our alumni in their unwavering dedication to give back to society as evidenced in the recent Forbes rankings!

Click here for more information on CKGSB’s efforts in social innovation and social responsibility.

Industry Experts Join CKGSB Professor, Zhu Rui, to Assess China’s ESG Environment at Asia House Event

Cheung Kong Graduate School of Business (CKBSB) Professor of Marketing and Director of the Social Innovation and Business for Good Center, Zhu Rui, along with industry experts shared insights on China’s global environmental, social and governance (ESG) reporting, its new environmental impact regulations and the future of ESG investment. Zhu was joined by Wang Xitong (Adeeb), Head of Senior Affairs/Senior Associate at Everbright Belt & Road Green Fund, Michelle Cameron, Head of Sustainable Investment and Finance Sales, Asia at Refinitiv (a subsidiary of the London Stock Exchange Group), and Phyllis Papadavid, Head of Research and Advisory at Asia House, at an event hosted by Asia House on May 17.

Optimism and Growth

Professor Zhu kicked off the webinar with a discussion on how attitudes towards ESG in China are shifting, “When I started teaching in 2016, the concept [of ESG] was very rarely known among my Chinese audience. Over the years, I saw a change in terms of how much people are paying attention [to ESG]”. Since 2021, Zhu has been leading the “Social Innovation and Business for Good” Field Course at CKGSB. The one-year, socially-minded field course requires students to initiate sustainable business practices in their companies or organizations. This field course started as a core course in the school’s Executive MBA program and is now being expanded to other programs.

The panelists expressed optimism towards the current ESG landscape. Zhu said, “during times of crisis, I see a greater demand from the public and consumers asking companies to pay more attention to be more responsible, to adopt ESG principles.”

Wang was also optimistic about the direction ESG is taking in China. He mentioned that the cumulative returns of the CSI 500 ESG benchmark index are 8.1% higher than the parent index.

He pointed out some key regulations in China: In 2020, the Hong Kong Stock Exchange required all listed companies to disclose ESG reports. In 2020, the China Banking and Interest Regulatory Commission issued a guidance requiring banking and financial institutions to incorporate ESG reporting into the entire credit granting process. In April 2022, the China Securities Regulatory Commission issued deadlines for listed companies to include ESG in the communication content of investor relations for the first time.”

However, Papadavid noted, “the push for sustainability comes at a time of heightened geopolitical and macroeconomic risk, and the nature of the slowdown means that persistent weakness in certain sectors of the economy will take precedence over the push for sustainability.”

Worldwide Challenges

One of the key themes that featured in the webinar was the challenge to ESG reporting in China and around the world due to a lack of unified standards in ESG reporting.

When Zhu first started teaching ESG related courses, she used the Sustainability Accounting Standards Board (SASB) which categorizes ESG standards across 77 industries. However, Zhu highlighted, “there are a lot of these guidelines around the world and criteria you have to meet, but some of them don’t quite fit into the Chinese context. For example, in the gaming industry, which falls into the “Internet Media and Service Industries” category, its ESG criteria relates to consumer privacy, data privacy, employee engagement and inclusiveness. But these issues are not what Chinese computer game companies pay attention to. They care more about gaming addiction in adolescents.” Zhu is now working with her colleagues to promote initiatives and guidelines for each industry centering around ESG principles in a Chinese context.

Cameron agreed with Professor Zhu, saying that “there are different weightings that need to be applied across different sectors depending on which parts of ESG they have more exposure to.” She also identified the problem that, due to many ESG data providers, there are many ways in which the data is collected.

Further discussion involved data consistency required for global ESG reporting. Cameron said, “we need to get to a point where we can run and compare data across the globe and look at the differences between the industries in the different jurisdictions.”

Wang developed this point further: “A lack of globally accepted standards is a problem…we have seen a lot of ESG or green finance rating agencies in the market, but each of them has their own set of ESG or green finance indicators and their own approaches to give ESG and green finance scores. A unified standard for ESG or green finance is important not only for investors but also for consultancy firms.”

Na KE

Biography

Dr. Ke Na is Assistant Professor of Accounting at the University of Hong Kong. Dr. Na graduated from University of Missouri, Columbia and received his PhD Degree in Accounting from Simon Business School, University of Rochester, USA in 2014. He currently teaches Introduction to Financial Accounting and Boot Camp of Economics for Master of Accounting.

CKGSB Dean Xiang Bing Speaks to Chosun Biz about the Development of China-South Korea Relations

This interview with Dean Xiang Bing was originally conducted and published by Chosun Biz in Korean and has been translated into English.

“In the 300 years since the Enlightenment, the global economy, politics, and culture have all been proposed and led by the Western countries. This trend should be changed through economic alliances between Asian countries, including China and South Korea.”

Cheung Kong Graduate School of Business, established in Beijing, is considered one of the top 4 business schools along with Peking University, Tsinghua University, and China Europe International Business School. Jack Ma, Founder of Alibaba, Liu Chuanzhi, Chairman of Lenovo, Guo Guangchang, CEO of Fosun, and Chen Yidan, co-founder of Tencent are some of the notable alumni of CKGSB. The proportion of alumni of CKGSB in top positions at China’s leading 100 companies is about 20%, making up the ‘Who’s Who of Business in China.’

Q. What is the most remarkable achievement of the two countries during the 30 years of diplomatic relations between Korea and China?

At the time of the establishment of diplomatic relations between Korea and China in 1992, the volume of trade of goods between the two countries was only USD $5.05 billion (about KRW 6.61 trillion).

However, as of 2021, it surged to USD $362.4 billion dollars (about KRW 474.74 trillion).

For South Korea, China has maintained its position as the largest trading partner for as long as 18 years, from 2004 to 2021.

According to data from the U.N Conference on Trade and Development, Korea’s exports to China in 1995 (early in the diplomatic relations between Korea and China) were only 7.31%, but increased to 25.28% in 2021.

The proportion of Chinese imports from Korea, which accounted for only 5.48 percent of total imports in 1995, also increased to 22.53 percent in 2021.

These exchanges are accelerating further due to the Korea-China FTA (Free Trade Agreement) that took effect in 2015.

The growth of the China-Korea relations goes beyond economics. As of April 1, 2021, there were 67,438 Chinese students studying in Korea, accounting for 44.2% of all foreign students (Korea Educational Development Institute). On the other hand, in China, 13 cities, including Hong Kong, have established Korean schools ranging from kindergartens to high school curriculums, with more than 5,400 students and more than 600 teachers working there. The two countries have developed a win-win relationship, covering various fields such as business, education, and culture.

Q. How will the two countries benefit from the Regional Comprehensive Economic Partnership (RCEP), which took effect on January 1 this year?

As of the end of 2021, the population of RCEP member countries comprises of 29.7% (2.29 billion) of the world’s total population and accounts for 30.57% of the world’s GDP ($29.43 trillion).

In particular, RCEP is the first free trade agreement involving all three countries: Korea, China, and Japan. According to data from the International Monetary Fund (IMF), the combined size of the three economies amounts to 25.1 percent of the global economy. RCEP will pave the way for the three countries to develop closer ties in the future. It will increase economic gains by increasing production and trade in these countries, especially in the high-tech manufacturing sector.

Q. Which industrial sector is particularly competitive for Korea in the Chinese market?

Korea has a competitive edge in semiconductors, electronics, and telecommunications. According to the Korea International Trade Association’s top 10 export items to China in 2021, electronic devices accounted for 41.7%, ranking first, and nuclear reactors, boilers, and mechanical equipment ranked second with 10.75%.

By industry, semiconductors, electric vehicles, and secondary batteries steadily dominate the export market. Korea’s new business sector is likely to remain competitive in the Chinese market in the future. This is because they quickly jumped to the early stages of global market growth and secured first-mover status and achieved quantitative growth in the global market.

Q. The Chinese government forecast economic growth of 5.5% this year. However, countries other than China expect China’s growth rate to be below expectations. What do you expect?

The key depends on the deregulation of the Chinese government. Recently, the Chinese government significantly eased regulations on oil, gas, and financial services. In the future, regulations on power generation, aviation, railways, and media may be eased. China’s unique economic system, driven by the government, is very different from that of the Western world. Therefore, it is very difficult to predict China’s economy by the standards of Western countries.

In addition, the impact of technological disruptions on the market cannot be ignored. Explosive growth may occur in areas such as the Internet of Things (IoT), big data, cloud computing, and Blockchain.

Therefore, an accurate prediction is difficult to make. However, given China’s unique economic system, this target is not impossible.

Q. You invented a unique concept called the Confucian Economic Sphere. Could you tell us about it?

In 2017, I coined CES, which stands for the Confucian Economic Sphere, combining four regions of China (including Hong Kong, Macau, Taiwan and mainland China) and eight economic regions, including Japan, Korea, Singapore, and Vietnam. As of 2021, CES’ GDP was USD $26.145 trillion (about KRW 3.4220 trillion), accounting for 27.15% of the world’s GDP. As of 2021, the number of CES companies among the “Fortune Global 500 Companies” stood at 215, accounting for 42%. In addition, the impact of CES is huge as the IMF expects it to drive global economic growth in the future.

“Korea and China are the main pillars of CES, both countries shall lead the world economy in the future.”

Q. What strengths does CES have over other economies?

In Samuel Huntington’s book, Clash of Civilization, he predicted that future wars would be fought over cultures. However, CES, which share the ideology of Confucianism and has relatively minor cultural differences.

I often visit Korea or Japan on business trips, and I have rarely felt a great cultural gap. But similarity this is not the only advantage. Even within CES, political and economic models between countries are different. They can learn from each other’s models.

Q. What should Korea and China do to continue a positive relationship in the future?

There is so much room for cooperation between the two countries. The markets of both countries can be further opened through RCEP, and new opportunities can be further expanded with the Comprehensive and Progressive Trans-Pacific Economic Partnership (CPTPP) and the China, Korea and Japan FTA. The relation between these three countries, China, Korea and Japan, should be reborn as future-oriented and go beyond historical conflicts of the past. We cannot dwell on the past and neglect our present interests. In fact, all EU member states were in territorial and religious disputes in the past. These three countries, which are the main pillars of CES, should create a more future-oriented relationship.

Until now, we have jumped on and followed the world order and values that the West has created. But now, CES should be at the center and contribute to the world by creating Asian values.

Q. How can CKGSB contribute to this goal?

As I emphasized, we should move beyond history and towards the future. At CKGSB, we’ve been nurturing a global mindset and global values from the start among our students.

I hope that the alumni of CKGSB will be able to contribute to the development of both countries within the framework of CES.

Liandong Zhang

Biography

Dr. Liandong Zhang is Professor of Accounting at School of Accountancy at the Singapore Management University. He joined Singapore Management University in 2017 as the Associate Dean (Research) at School of Accountancy. Dr. Zhang graduated from Tsinghua University, Beijing and received his PhD Degree in Accounting from Nanyang Technological University in 2008. He has previously taught at the Concordia University in Canada and City University of Hong Kong. His current research interests include financial reporting quality, corporate governance, and taxation. He currently teaches Accounting Theory.

Huai Zhang

Biography

Dr Huai Zhang received his Ph.D in Accounting from Columbia University in 2000. He taught at University of Illinois at Chicago and was promoted to Associate Professor with tenure at University of Hong Kong before joining Nanyang Business School in 2006. He has published in major accounting and finance journals, including Journal of Accounting and Economics, Journal of Finance and Review of Accounting Studies. He received the Best Paper Award at the 2004 International Finance Conference and the 2016 Midwest Finance Association Meeting. He was also the recipient of Nanyang Business School Research Excellence Award in 2011 and 2013. He sits on the editorial board of Review of Accounting and Finance and The International Journal of Accounting, both refereed academic journals, and is an ad hoc reviewer for journals such as Journal of Accounting Research, The Accounting Review, Contemporary Accounting Research and Review of Accounting Studies. He is the keynote speaker at the 5th Annual International Conference on Accounting and Finance, the 1st Boya Management Accounting Research Forum, and the 14th International Symposium on Accounting Research in China. In recognition of his contributions to China-related studies and his efforts in nurturing local researchers, the Fujian Province Government in China conferred him the title of “Ming Jiang Scholar” (闽江学者) in 2015.

Sterling HUANG

Biography

Dr. Sterling Huang joined Singapore Management University in 2014. He received his Master of Science and Ph.D. in Management from INSEAD Business School. Prior to his doctoral studies, he was an auditor with PricewaterhouseCoopers (Sydney) and a lecturer at Macquarie University Australia. He has published in the Journal of Accounting Research, The Accounting Review, Review of Financial Studies, Strategic Management Journal, European Accounting Review and Journal of Accounting, Auditing, and Finance. His work has been cited multiple times in major media outlets and practitioner forums, such as Wall Street Journal, Thomson Reuters, Bloomberg, INSEAD Knowledge, Harvard Business Review, Booz & Co Strategy & Business Magazine, Chief Executive Magazine, American Banker Online, Finance & Development (IMF), the Harvard Law School Forum on Corporate Governance and the Columbia Law School’s Blog on Corporations and the Capital Markets. He is a Chartered Financial Analyst Charterholder and a member of Institute of Chartered Accountant Australia.

Peer Firm Selection and Executive Compensation: The Case of Dual-role Peers

Abstract

The Securities and Exchange Commission’s 2006 Executive Compensation Disclosure Rules require firms to disclose how executive pay is determined by benchmarking total compensation at the competitive labor market level (compensation benchmarking) and by benchmarking performance targets in relative performance evaluation (performance benchmarking). Prior studies examining the selection of peer firms typically focus on one or the other benchmark. Using Incentive Lab’s detailed data on proxy statements from 2006 through 2015, we find that approximately 57% of the peers are used simultaneously for both compensation and performance benchmarking, a pattern largely ignored in prior literature. We label these peers as “dual-role peers” and show that firms can indeed succeed in selecting such peers in order to achieve high pay and yet low expected performance. Moreover, we find that the extent of such discretionary peer selection is positively associated with realized excess CEO pay, and negatively associated with ex-post stock performance in the subsequent year. Additional evidence shows that the power of CEOs to intervene the boards’ compensation decisions exacerbates the opportunistic peer selection. Our study provides new evidence on managerial self-serving behavior in compensation practices and highlights the importance of considering dual-role peers in compensation research.

Government Ownership, Non-CEO Top Executives’ Horizontal Pay Dispersion and Firm Performance

Wei Jiang, Bin Ke, Hong Ru, and Yue Xu

Abstract

The objective of this study is to analyze the compensation practices of non-CEO top executives as a group measured by horizontal pay dispersion. We address two specific questions. First, we examine whether government ownership affects non-CEO executives’ horizontal pay dispersion. Second, we examine how such ownership-induced horizontal pay dispersion affects firm performance. We find that non-CEO top executives’ horizontal pay dispersion is lower in government-controlled firms (SOEs) than in privately-controlled firms (non-SOEs). We show that the difference in horizontal pay dispersion between SOEs and non-SOEs is consistent with the institutional differences between the two ownership types. There is evidence that such ownership-induced horizontal pay dispersion is associated with lower firm performance, suggesting that SOEs’ horizontal pay dispersion is suboptimal from the perspective of shareholder value maximization.

Direct Evidence on Earnings Used in Executive Compensation Performance Measurement

Abstract

Motivated by competing theories on the properties of earnings required for compensation performance measurement, we provide direct evidence on the properties of actual accounting earnings that are used in determining compensation payouts (Compensation Earnings). Using a large sample of manually collected Compensation Earnings for U.S. firms, we show that firms make economically significant adjustments to GAAP Earnings in arriving at Compensation Earnings. While GAAP Earnings exhibit conservatism, we fail to detect conservatism (either by statistical significance or by magnitude of coefficient) in Compensation Earnings using the same sample and the same research design. The absence of conservatism in Compensation Earnings is also documented in various subsamples partitioned on market-to-book ratio, leverage, firm size, and corporate governance. Further analyses indicate that the adjustment from GAAP Earnings to Compensation Earnings involves the removal of less persistent components of GAAP Earnings, resulting in Compensation Earnings that are more persistent than GAAP Earnings.

Do Repatriation Tax Holidays Promote Corporate Social Responsibility? Evidence from the American Jobs Creation Act

Abstract

In response to the temporary tax holiday introduced by the American Jobs Creation Act, U.S. multinational corporations repatriated approximately $300 billion from their foreign subsidiaries to the United States. We find that repatriating firms invest at least a portion of the repatriated funds in corporate social responsibility (CSR) initiatives, as evidenced by increasing CSR performance of the repatriating firms relative to non-repatriating firms during the years after the repatriation. The effect of repatriation on CSR performance is more pronounced for financially unconstrained firms, poorly governed firms, and firms located in states with stronger stakeholder preferences for CSR.