Suan Teck Kin, CFA, Head of Research, Executive Director, Global Economics and Markets Research, United Overseas Bank (UOB)

Teck Kin joined UOB as an economist in 2006. In his current role as Executive Director in Global Economics and Markets Research, he is responsible for macroeconomic and foreign exchange research with a primary focus on mainland China, Hong Kong and Taiwan, and secondary coverage for the ASEAN region. As a member of the Research team, he presents the team’s market views regularly to the Bank’s management team and clients in Singapore and the region. Teck Kin has more than ten years of experience in macroeconomic and equity research. Fluent in English and Mandarin, Teck Kin is interviewed frequently by local and international print and broadcast media, as well as financial newswires on the economic and market outlook.

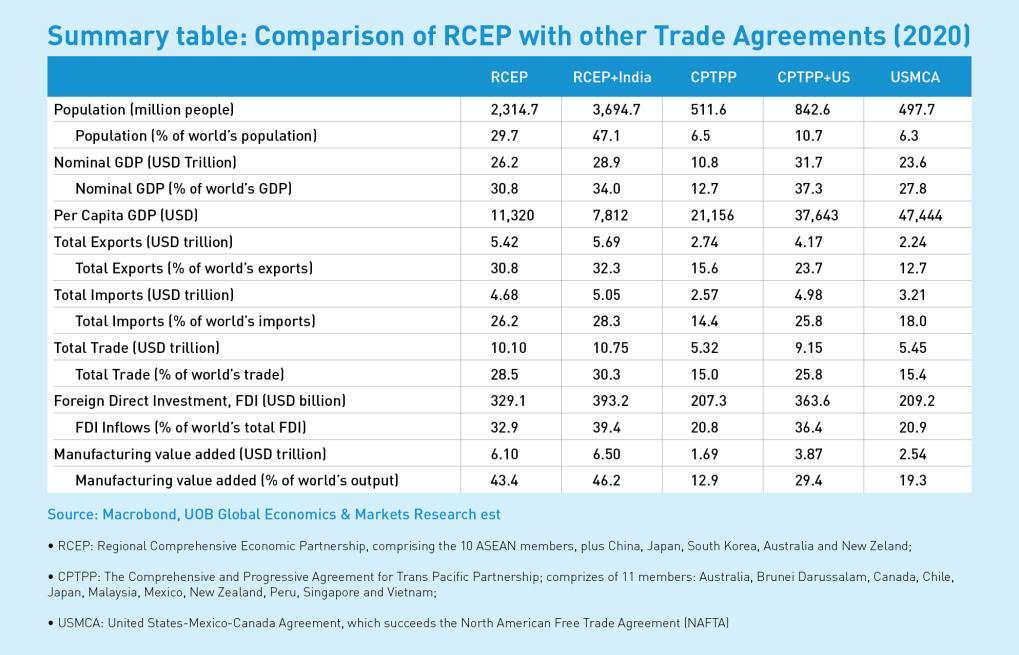

RCEP is China’s largest trade partner accounting for more than 30% of China’s total trade (Jan-Sep 2021), compared to ASEAN’s 14% share in China’s total trade.

As the world’s second largest economy, China’s merchandise trade with the RCEP members is already quite substantial. As a group, RCEP is China’s largest trade partner accounting for more than 30% of China’s total trade (Jan-Sep 2021), compared to ASEAN’s 14% share in China’s total trade. In addition, China’s Belt & Road Initiative (BRI) will also be entrenched further within the RCEP context, as many member states are also connected via BRI.

With China’s retail market set to overtake the US to become the world’s largest in the years ahead, it is important that businesses have access to opportunities in such a sizeable market and in the most efficient manner.

Coupled with the rising affluence in ASEAN itself, RCEP will help attract investors beyond the region as the Chinese and regional markets will be seen as an “integrated market”.

As such, RCEP fits well into China’s dual circulation strategy, which capitalizes its large domestic market at the core of the strategy, and interacts the domestic market with the external market through trade, investment and capital flows and its manufacturing capability. With nearly half of the world’s manufacturing output produced by RCEP members, the Agreement will further elevate their export competitiveness and efficiency.

As RCEP integrates economics and markets in the Asia Pacific further, there is a reasonable chance that China will be able to achieve the doubling of the Chinese economy by 2035. This will in turn reinforce the growth and economic prospects of RCEP members.

What is Next for RCEP?

RCEP will eliminate as much as 90% of the tariffs on imports between its parties, and some of the cuts would take place 20 years after the ratification of the agreement .

India pulled out of talks in Nov 2019, concerned that the elimination of tariffs would open its markets to a flood of imports that could harm local producers. While there may be a chance that India could rejoin in future, RCEP on its own is already quite a substantial FTA. This is unlike the CPTPP, which is just a shadow of its former self without the participation of the US.

President Trump withdrew the United States from the Trans-Pacific Partnership (TPP) in 2017, which was set to become the world’s largest trade agreement at that time. Even with the absence of an anchor economy, the remaining 11 member states of the TPP forged the CPTPP, which entered into force on 30 December 2018. CPTPP is about half the size of RCEP in terms of GDP and export value.

With RCEP showing the way forward, it remains to be seen whether the US will rejoin CPTPP to exert its influence in global trade. To a certain extent, the demise of TPP and rising trade protectionism in subsequent years could be a key catalyst for the accelerating of the RCEP into reality. However, with China indicating its interest in joining the CPTPP, a successful bid will bolster the size and influence of CPTPP significantly.