CKGSB Holds Breakfast Seminar with KPMG to Discuss the SHFTZ

Beijing, December 17, 2013 – Upon the launch of the China (Shanghai) Pilot Free Trade Zone (“SHFTZ”), CKGSB collaborated with KPMG to hold a breakfast seminar with senior executives of Japanese companies in Beijing on December 17, 2013. The purpose of this seminar was to clarify the opportunities and challenges that foreign multinational companies may experience in the zone. Shedding light on the implications of SHFTZ were two distinguished speakers, CKGSB Associate Dean and Professor of Finance Chen Long and KPMG’s William Zhang. The highlights of their insights are summarized below.

Guest Speaker #1 – Dr. Chen Long (Professor of Finance, Associate Dean of DBA Program and Alumni Affairs, and Director of Asset Valuation Center) – Overview of the Shanghai Free Trade Zone

How is the China (Shanghai) Pilot Free Trade Zone Defined?

In explaining the Chinese government’s strategy on establishing the zone, Prof. Chen highlighted three key words: ‘China’, ‘Pilot’, and ‘replicable’. Initially approved by the government in July 2013, SHFTZ was interpreted by the state as to benefit trade, shipping and tariffs. However, in the two to three months following SHFTZ’s approval, the government escalated this mandate to the national level by emphasizing the terms ‘China’ and ‘Pilot’, implying that this experiment could ultimately be expanded throughout mainland China. Hence, the purpose of the zone would primarily be to test new strategies that the government seeks to implement and determine how they would benefit the market as a whole.

Furthermore, the Shanghai Free Trade Zone seeks to “turn Shanghai into an investment, financial, and governance environment on par with international standards,” explained Prof. Chen. This was very helpful in revealing what the government would be focused on going forward.

Brief Background on SHFTZ

In further explaining the reasons behind establishing SHFTZ, Prof. Chen shed light from both an international and domestic perspective. Firstly, the failure of the WTO negotiations demonstrated the necessity of building such a free trade area. Secondly, the three major international trading agreements – the Trans-Pacific Partnership Agreement (TPP), the Transatlantic Trade and Investment Partnership (TTIP), and the Plurilateral Service Agreement – have excluded China. This is due to the fact that China has not yet reached the requirements that these agreements stipulate regarding state-owned enterprises, government capital, intellectual copyrights, environmental protection, labor protection, and other issues. Therefore, if China seeks to engage in free-flow trade, it would need to improve on these aspects and meet the requirements above, with SHFTZ as a great first step towards achieving these milestones.

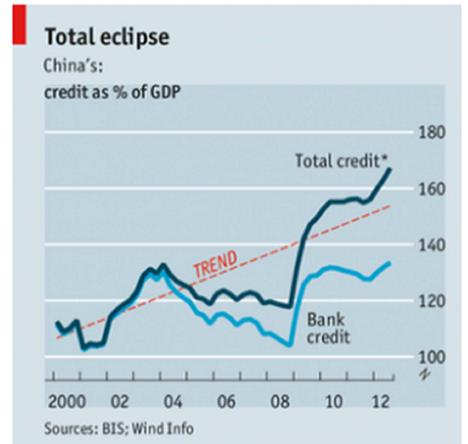

From a domestic perspective, there are a number of reasons behind SHFTZ’s establishment. First of all, China’s economy has been credit driven (also known as investment driven). The total social credit and the fast growing shadow banking trend both demonstrate fast-paced growth of the money supply. However, the recent slow-down of China’s economic growth has revealed the inefficiencies of its economy. As money was continuously being lent to inefficient businesses in order to keep them afloat, this led to increasing inflationary pressure. This vicious cycle eventually led to China’s money shortage experienced in June 2013, exposing panic in the banking sector.

Prof. Chen also added that falling returns on investment and inadequate funding for small and medium-sized companies, as well as extremely high grey market interest rates, have all convinced the government that it needs to reform. Moreover, the uncertainty of the newly-elected government has also negatively impacted foreign investment to a certain degree.

Due to the aforementioned reasons, the government decided in July of 2013 to establish SHFTZ in order to implement the necessary economic reforms through a pilot area that could ultimately be replicated throughout the rest of China, and to do so in Shanghai initially — considered to be the major financial hub of China — revealed the government’s keen interest in financial reform.

One of the most active proponents of the zone has been Li Keqiang, China’s Premier. “Thirty years ago, China’s reforms were led by the Special Economic Zones,” said Premier Li. “It is time to find a new pilot zone to fuel a new round of reform through opening up. There is still great room and potential, and Shanghai has all of the conditions necessary to realize this.”

Major Reform through SHFTZ

Upon explaining the rationale for establishing SHFTZ, Prof. Chen then described the key reforms of the zone and their implications. “First, the government seeks to upgrade its trade and shipping services through SHFTZ,” explained Prof. Chen. With respect to trade, SHFTZ would include trade, logistics, settlement, financing and other service centers, commodity (futures) trading and delivery, as well as supply chain financing and leasing. At the same time, it would also feature shipping centers with international competence and operations.

Secondly, the government plans to reshape the investment environment. These reforms include switching to a “negative list” – in which foreign and private companies are allowed to operate in all sectors from which they are not specifically barred – and allowing companies to set up operations through a registration system rather than through lengthy and inefficient government approvals.

“With controlled risk, China will also create conditions to test the RMB’s convertibility under the capital account, market-based interest rates and cross-border use of the Chinese currency in the zone,” said Prof. Chen. In addition, the government has pledged to “establish a foreign exchange management mechanism appropriate for trade and investment reforms in the zone. Enterprises are encouraged to participate in cross-border financing and multinationals are encouraged to establish regional headquarters or global capital management centers in the zone.” Moreover, foreign companies will be permitted to gradually participate in commodities futures trading in the zone.

Implications for the Future

Because of the reforms prescribed by SHFTZ, the role of the Chinese government is changing, which will be an interesting shift to watch.

Moreover, reforms introduced in SHFTZ also lead to several other important implications. By relaxing controls over investment and restrictions that limit foreigners from investing in China’s capital markets and refrain Chinese from investing abroad, SHFTZ will simplify the IPO process in China as well as abroad. These reforms could help Shanghai meet its goal of becoming a truly global financial center.

Guest Speaker #2 – William Zhang (KPMG Partner – Shanghai) – Business Operations in SHFTZ[1]

The second guest speaker, William Zhang, expanded on business operations within SHFTZ by showing more concrete examples from KPMG’s client base. He started by pointing to the great interest that the launch of the zone has generated among his clients, leading KPMG to develop a team specifically aiding clients on SHFTZ related issues. At the breakfast seminar, Mr. Zhang reflected on the concrete opportunities, challenges, rules and recommendations for foreign enterprises seeking to develop their businesses in SHFTZ.

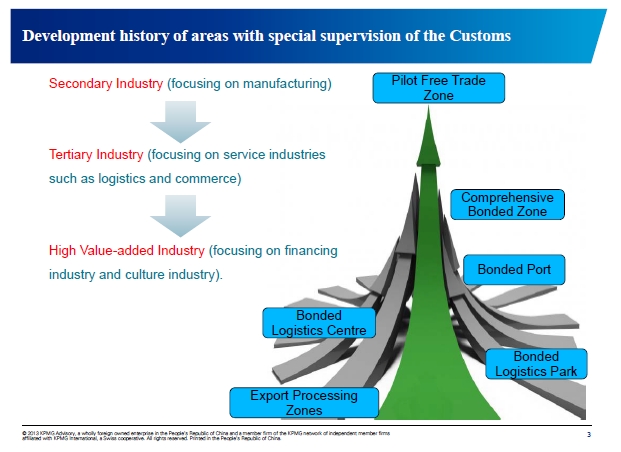

History of Customs’ Supervision in Special Zones

The development of the history of customs’ supervision has gone from focusing only on industries in manufacturing and processing to companies handling trade and logistics. With the launch of SHFTZ, new policies have provided additional areas for foreign investors to invest in the finance industry.

Advantages of SHFTZ

Firstly, there’s no approval requirement as long as the area in which the clients are investing is not in the ‘negative list’. Generally, when establishing a foreign investment company in China, China’s Ministry of Commerce would need to grant necessary approvals, after which the company would need to register with the local Administration for Industry and Commerce. When a company is being established within SHFTZ, it will only need to deal with the latter, increasing efficiency. In addition to the set-up, SHFTZ offers additional benefits with respect to liquidation and annual company inspection. Secondly, the zone also helps facilitate the movement of foreign currency within the capital account.

In China, the foreign industry investment guideline is reviewed by the Ministry of Commerce in Beijing, and it will only be reviewed on a four to five year basis. On the other hand, the negative list is reviewed by the administrative committee of SHFTZ on a more frequent basis, making its rules and guidelines more up-to-date.

Last but not least, SHFTZ also offers advantages to outbound investments. Companies may set up their head office in the Free Trade Zone to invest overseas. When domestic companies go abroad, normally they would prefer to set up their headquarters in Hong Kong or Singapore. The reason they seek to do so outside of mainland China is to avoid the steep corporate income tax rate of up to 25%, and choose lower tax-rate jurisdictions such as Singapore or Hong Kong. In an attempt to reduce the income tax burden gap between mainland China and the lower tax rate jurisdictions, SHFTZ is considering reducing the corporate income tax rate on foreign sourced dividend income of companies headquartered in SHFTZ from 25% to15%. However, the Chinese government will still control the money coming in and out of the country by certain regulations.

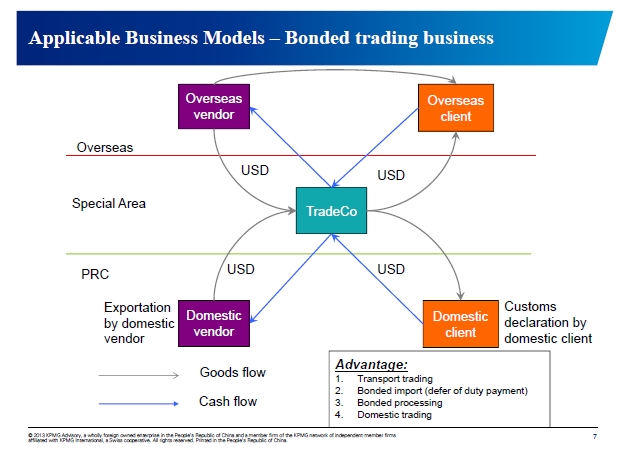

Bonded Trading Business Model

Let’s now look at a company and how it works in the Pilot free trade zone. As shown in the graph below, there are basically three typical transaction flows for a trading company in SHFTZ.

A trading company in SHFTZ can conduct transport trading business under which the company can purchase products from overseas suppliers and then sell to overseas customers without triggering PRC customer duties or value-added tax (“VAT”).

When domestic suppliers sell goods to a trading company in SHFTZ, the transaction could be viewed as exportation and the domestic suppliers hence may apply for the VAT refund. When the trading company exports the underlying goods at a later stage, the further selling transaction would be viewed as a transaction outside of China which would not be subject to any PRC customs duties or VAT.

As for imports, the trading company can import goods on a bonded status (i.e., without triggering any VAT or customer duties).

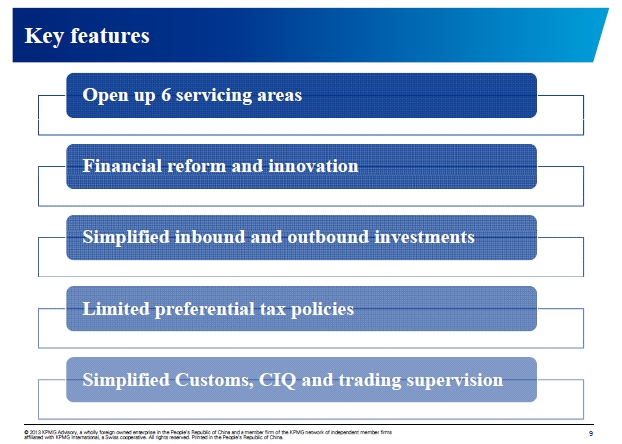

Additional Features of SHFTZ

Firstly, the Chinese government authorities may soon revise the negative list, which will provide even greater advantages to foreign investors.

Secondly, in terms of financial reform and innovation, it may mainly focus on the facilitation of cross-border settlement in RMB.

Thirdly, as a result of the simplified inbound investment procedure, investors only need to register with the in-charge Administration for Industry and Commerce to set up a company in SHFTZ. As for outbound investment, the administrative committee of SHFTZ is responsible for the registration of outbound investment projects initiated by the companies in SHFTZ, which saves a few more steps.

Lastly, SHFTZ also provides companies with simplified customs, China Inspection and Quarantine (“CIQ”) and trading supervision. Companies were previously required to clear customs declaration before importing goods from overseas into SHFTZ, whereas now the “Enter First Clear Later” approach makes the process easier and more simplified for companies in SHFTZ (e.g., for “Enter First”, the company only needs to show to customs an internal import document).

Restrictions to the Pilot Free Trade Zone

Although SHFTZ offers numerous advantages, there are still some restrictions and uncertainties that we are concerned about that need to be worked out in the near future. One limiting factor may be that the reforms won’t be as easily replicated elsewhere in the country, since Shanghai is a highly developed city with strong human capital and governance of a different standard than other parts of China.

Conclusion

The breakfast meeting jointly organized by CKGSB and KPMG on SHFTZ offered a more comprehensive understanding of the rationale behind its establishment, key reforms and their implications, and details on the opportunities and challenges regarding business operations. As Prof. Chen argued, the most interesting part of the zone is not what it can do in the short run, but rather the insights it offers into the government’s longer-term plans.

References

Powerpoint slides by Professor Chen Long – ‘SHFTZ’

Powerpoint slides by William Zhang – ‘Updates on China (Shanghai) Pilot Free Trade Zone’

[1] Note: These presentation slides and associated comments from William Zhang, which have been prepared for the breakfast meeting, are based on specific facts and circumstances in China. They should not be relied upon by any other person. Those who choose to rely on these slides and/or comments do so at their own risk. To the fullest extent permitted by law, KPMG in China accepts no responsibility or liability to them in connection with the slides and/or comments.