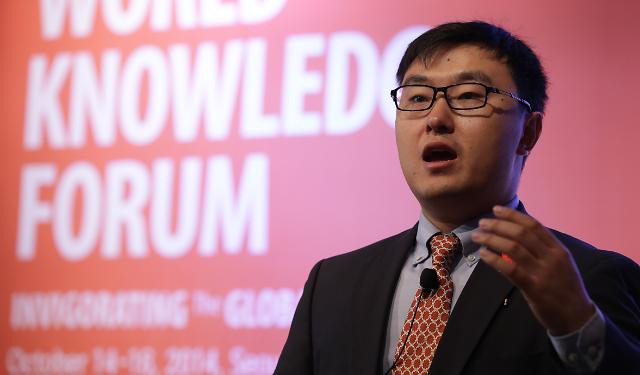

More coverage for CKGSB from the Korean media came recently after the Aju Business Daily interviewed Associate Professor of Economics and Finance at CKGSB Li Xiaoyang and current CKGSB EMBA student Li Kan, Managing Partner at Long Capital & Partners, about the outlook for M&A in China and its impact on Korea. The pair were speaking following the World Knowledge Forum in Seoul. A summary of the article is below.

Associate Professor of Economics and Finance at CKGSB Li Xiaoyang said, “Since China’s cross-border M&A fever started in 2005, its numbers and size are increasing, and given the number of deals done in the first half of 2014, full-year results for 2014 will exceed expectations.” Compared to the past when Chinese companies mostly made acquisitions in the energy sector, they have now diversified into the IT, manufacturing, finance, consumer, healthcare industries. In addition, the increased desire of private companies to invest with their growing amount of capital, coupled with the Chinese government’s policy support, has led to an expansion of cross-border M&As. With rising interest in Korean companies, which are known for their outstanding technology and quality, Prof Li said Chinese companies’ M&A of Korean companies would increase, especially in the IT and consumer sectors.

With regard to Korean companies’ investment in China, Mr. Li Kan explained, “Chinese government regulations in the automobile and entertainment industries can be an obstacle for Korean companies when entering the Chinese market”. He further emphasized, “Patience is required in the Chinese market. Long-term strategy and insight are necessary because there is a big chance to fail if you expand the business in a couple of years simply to gain large profits in the China market.” He also advised that China welcomes Korean companies’ expansion to China, adding that, “If they target the Chinese market with a long-term perspective while strengthening their market position and improving brand awareness, many Korean companies will find success. For an industry that understands Korean trends and culture, it is important to select the right investment areas.”

Regarding the growing concern on the fast inflow of Chinese money along with Chinese companies’ aggressive investment strategy, Mr. Li answered as follows, “In the past, when Japanese large capital flowed into the US, there were great concerns, and campaigns launched to ‘Buy American’ to protect against the invasion of Japanese capital and culture, and the leakage of American technology.” But he said that since Korea owns an unique administration system, company culture, and the best technology industry that cannot be emulated by other countries, the inflow of China money would not be a big threat to the Korean economy.

Read the original Korean article on Aju Business Daily website here.