On July 8th, 2024, CKGSB Finance Professor Mei Jianping published the latest MM Chinese Art Indices, evidencing changes in the popularity of the Chinese art market by analyzing repeated auction sales. Covering prices, sentiment, liquidity and popularity, the new set of figures takes our understanding of the Chinese art market prices up to Spring 2024.

The Indices cover artworks by more than 400 Chinese artists from the Greater China region and overseas that have been repeatedly put up for auction between 1980 and 2024. The 2024 Spring Auction Index shows that the Chinese art market is still in a period of consolidation, with a somewhat slowing downward trend. Chinese art continues to hold long-term investment value. As a physical asset, it is anti-inflationary in a world flush with liquidity. Therefore, with the development of China’s economy and the growth of worldwide Chinese wealth, Chinese art is expected to continue to receive interest from collectors and investors.

The Indices are the result of the popularity of Chinese art, rising to comprise 20%1 of the global art market, second only to the US, according to the 2021 Art Basel and UBS Global Art Market Report. The Indices offer systematic and comparable data on which to evaluate purchase decisions regarding Chinese art, a black box to many in the art investment world. With the Indices in hand, investors can apply objective benchmarks to the valuation of Chinese art, which in turn may help the market to grow at a sustainable pace.

The long-term study is based on auction records from Sotheby’s, Christie’s and Phillips, sold in Beijing, Shanghai, Singapore, Paris, London and New York. The data comes from hammer prices at auctions derived from the official websites of the three major auction houses. The MM Chinese Art Indices, co-developed by Professor Mei Jianping, Michael Moses, a retired professor at New York University, and Jiang Guolin, a retired researcher at the Shanghai Academy of Social Sciences, examine prices, sentiment, and artists liquidity.

1. The Market for Chinese Artworks in Spring 2024

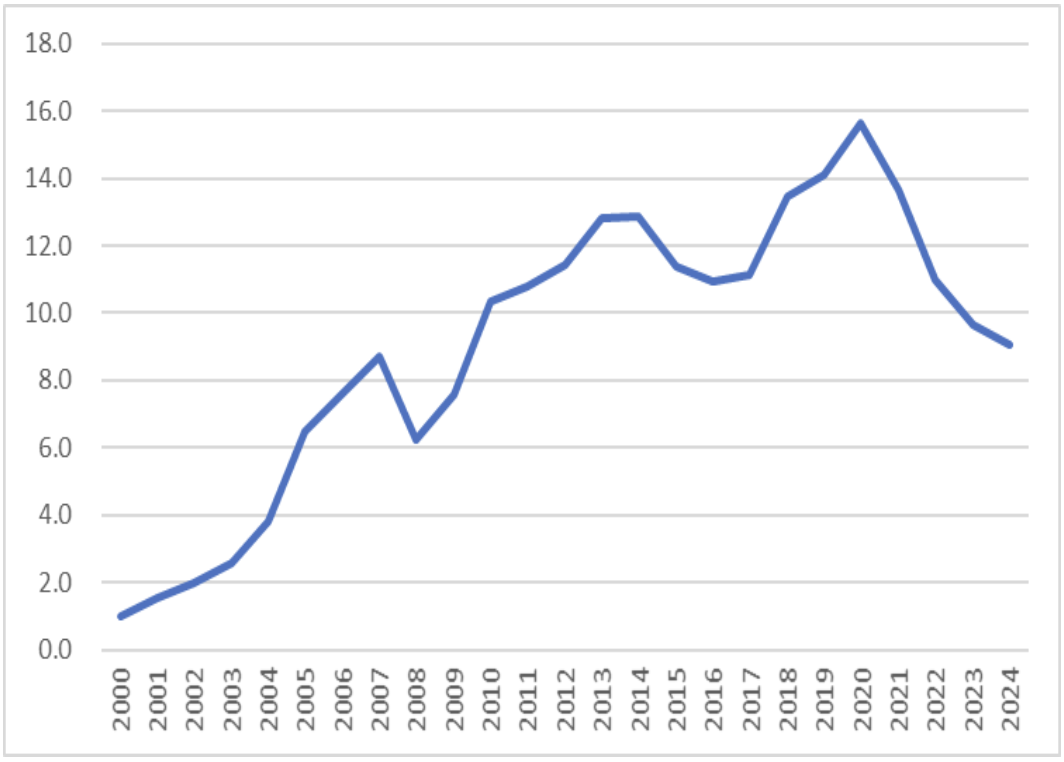

The MM Chinese Art Price Index rose from 1 to 9.5 between 2001 and the end of 2023, a compound annual growth rate (CAGR) of 10.3%. The Index shows that in Spring 2024, auction prices fell 6.2%, continuing a downward trend after the pandemic, but at a slower rate (Figure 1). In light of the impact of the pandemic and a Chinese economy in transition, we note that the Chinese art market has entered a period of adjustment since reaching its peak in 2020, and will take some time to recover.

2. MM Chinese Art Indices – Four Sub-Indices

To capture a unique segment of the Chinese art market, the MM Chinese Art Indices include separate indices for ink paintings and oil paintings. To study the relationship between the era in which the artist lives and the art market, the MM Chinese Art Indices also include modern and contemporary indices, covering artists born prior to 1911, and since then. In Spring 2024, the ink painting index rebounded strongly, breaking the downward trend since 2012, returning to its 2016 level and outperforming the oil painting index. By the same token, the modern index also did better than the contemporary index in spring 2024 (Figure 2 & Figure 3).

3. New Wu Guanzhong Price Index

Between 2001 and 2024, Wu Guanzhong sold more than 700 paintings for a total of US$440 million at the three major auction houses. Wu Guanzhong’s long-term price trend is quite strong, with a compound growth rate of 11.6% from 2001 to the Spring of 2024, only slightly lower than that of his fellow China Academy of Art alumnus Zao Wou-Ki’s 11.9%. Wu Guanzhong’s age value curve peaked at about 51 years old, indicating that collectors are willing to pay the highest premium for works created around that age.

The data for the individual artists’ indices comes from the auction records of the top three auction houses in Beijing, Shanghai, Singapore, Paris, London and New York. The methodology and model applied are based on an article and research published by Professors Mei Jianping, Michael Moses and Zhou Yi in the Journal of Cultural Economics (2023). The model can estimate the artist’s age of highest creative value and sensitivity to market fluctuations. These results could aid investors and art history research.

4. The MM Chinese Art Sentiment Index

The MM Chinese Art Sentiment Index measures the “temperature” of the market, starting with a mean value of zero. Since the data needs of the sentiment index are not as stringent as for the price index, we start in 2000, dividing each year into Spring and Fall sales. According to Figure 5, the Chinese art market sentiments can be divided into three periods: Spring 2000 to Spring 2008; Fall 2008 to Spring 2014; Fall 2014 to Spring 2024. In the first period, the sentiment index often exceeded 0.5, thus bidding was quite fierce and artworks were on average sold for 50% higher than average estimates. In the second period – affected by the global financial crisis, the sentiment index fell sharply, and then it gradually recovered. In the third period, the sentiment index fell to new lows in the Spring of 2020 and in the Spring of 2023. Although the 2024 Spring season showed that the collectors’ confidence recovered a little, market sentiment remained relatively sluggish (Figure 5).

5. MM Chinese Art Liquidity Index

The purpose of constructing the MM Chinese Art Liquidity Index is to measure the liquidity of artists’ works. It consists of three indicators: the number of years when the artist’ works were auctioned during the last 25 years, the sale rate and liquidity, which is the combination of the number of years of auction and the sale rate. According to the liquidity index, between 2000 and 2024, the artists with the most liquidity were Wu Guanzhong, Zao Wou-Ki and Lin Fengmian.

Conclusions

The 2024 Spring Auction Index shows that the Chinese art market is still in a period of consolidation, and the downward trend continues, albeit at a slower rate. Chinese art continues to hold long-term investment value. As a physical asset, the artworks should offer an inflation hedge during a period of abundant global liquidity. Therefore, with the development of China’s economy and the growth of worldwide Chinese wealth, we expect that Chinese art will continue to receive strong interest from collectors and investors.