Art Investing, Asset Pricing, Culture and the Arts, International Finance, Market Manipulation, Real Estate Finance, Wealth Management

Phone: +86 10 8518 8858 ext. 3322

E-mail: jpmei@ckgsb.edu.cn

Professor of Finance, Cheung Kong Graduate School of Business (CKGSB)

PhD, Princeton University

Areas of Expertise: Art Investing, Asset Pricing, Culture and the Arts, International Finance, Market Manipulation, Real Estate Finance, Wealth Management

Biography

Professor Mei Jianping is a Professor of Finance at CKGSB. His major areas of research include international asset pricing and real asset finance.

Mei earned a PhD in Economics from Princeton University and BS in Mathematics from Fudan University. He has taught at the University of Chicago, Princeton University, New York University, Tsinghua University, University of Amsterdam, Bocconi University and Hong Kong University of Science and Technology.

He has published over 30 articles in the American Economic Review, Journal of Finance, Review of Financial Studies, Journal of Financial Economics, Real Estate Economics, Journal of Real Estate Finance and Economics, and other academic journals. He has received several “Best Research Paper” awards from various academic organizations. His research has been covered extensively by major news media in China, the US, UK, Germany, Italy, Netherlands, Japan, Canada, Korea, Taiwan and Singapore.

Mei has served as a consultant and financial advisor to some of the largest financial institutions in the world, including Prudential Insurance of America, Fidelity Investment, UBS Warburg, Asia Development Bank, and HSBC Asset Management. He provides international asset allocation and real estate investment research to top decision makers and their clients.

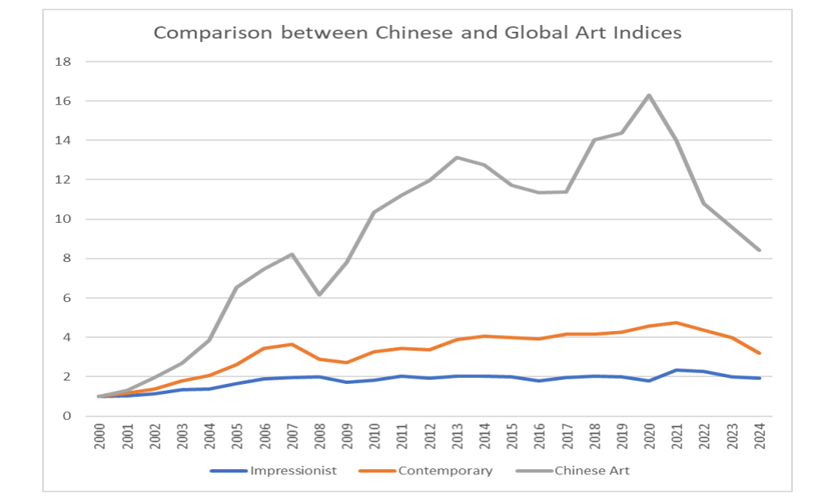

Mei was a principal developer of the Sotheby’s Mei Moses Fine Art Price Indices, which was covered in the New York Times, Wall Street Journal, Financial Times, Barron’s, Los Angeles Times, Business Week, Time, Forbes and other world news media.