Although China’s official GDP for the first two quarters (each at 6.9% year-over-year) and industrial growth exceeded expectations, China’s industrial economy has not yet bottomed out.

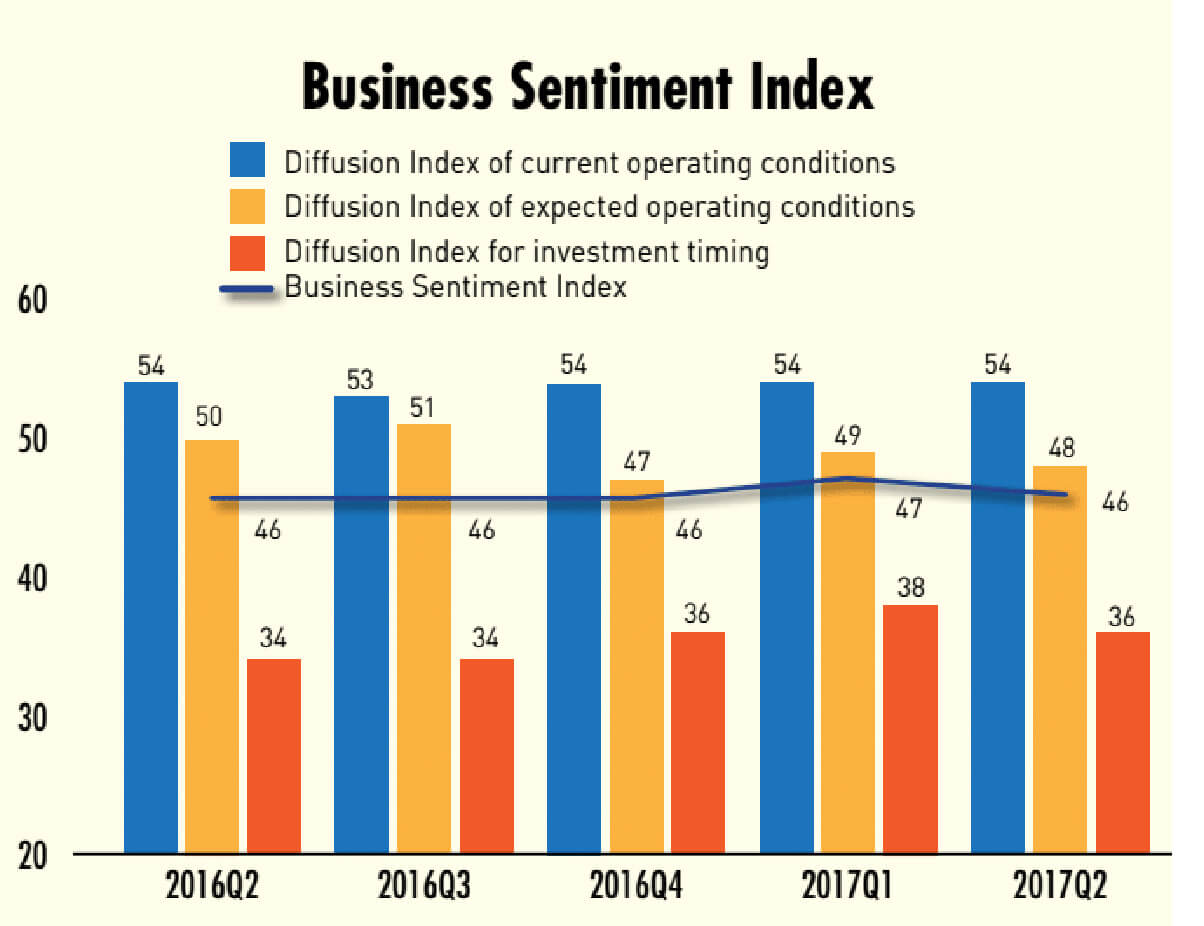

The CKGSB Business Sentiment Index in the second quarter stood at 46, down from 47 in the previous quarter, but still indicating a slight contraction. Moreover, overcapacity remained at a historical high, both in terms of its prevalence and severity, and product and cost prices continued to rise, while production stayed flat.

At the same time, the gap between the BSI of state-owned enterprises and that of private enterprises widened a bit—they are 61 and 51 respectively. All these findings suggest that the structural problems of China’s industrial economy remain a significant concern.

The CKGSB BSI, directed by Gan Jie, Professor of Finance at the Cheung Kong Graduate School of Business, is based on data collected from our quarterly surveys of around 2,000 industrial firms in China.

A total of 2,050 firms surveyed for the 2017 Q2 report, of which 1,670 firms were also polled in the 2017 Q1 survey. The survey design ensures that our sample fully represents industry, region and company size.

Business Sentiment Index

- The low BSI in Q2 was, as in previous quarters, a result of weak investment

- Only 1% of the firms considered it to be a “good” time to make fixed-asset investments

- 71% and 28% replied “average” and “bad” respectively

* The BSI is the simple average of three diffusion indices: current operating conditions, expected change in operating conditions and investment timing. A reading above 50 indicates expansion, while a reading a below 50 indicates contraction.

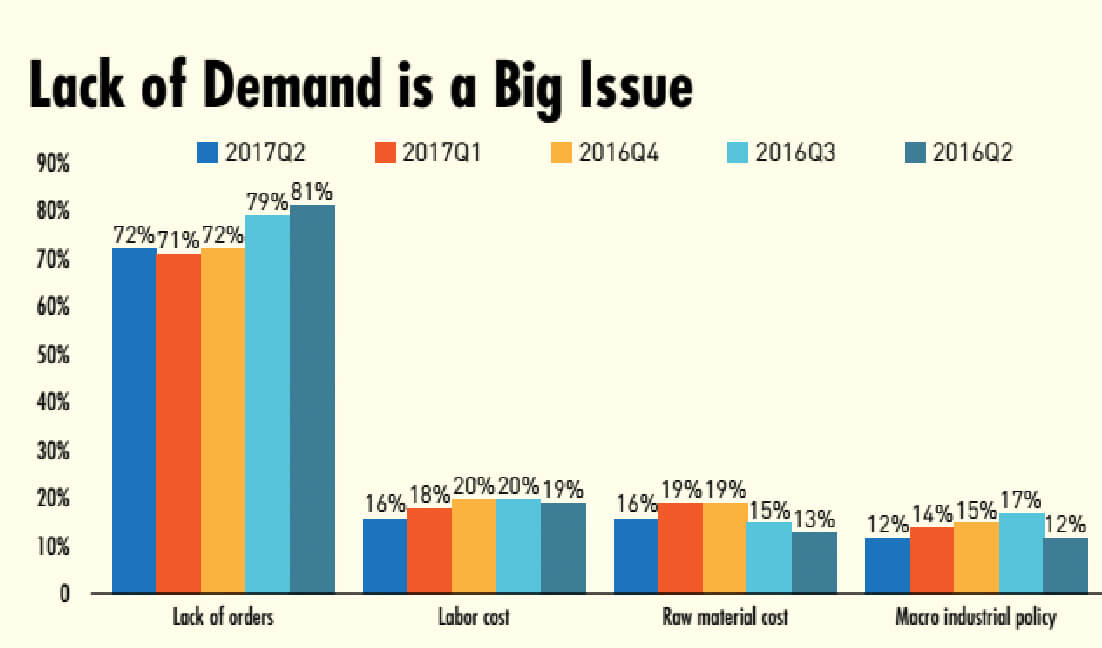

Lack of Demand is a Big Issue

- Weak demand is still by far the biggest challenge for the industrial economy

- 72% of the firms surveyed in Q2 indicated lack of orders

- Costs were listed as the second largest issue, particularly labor and raw material costs

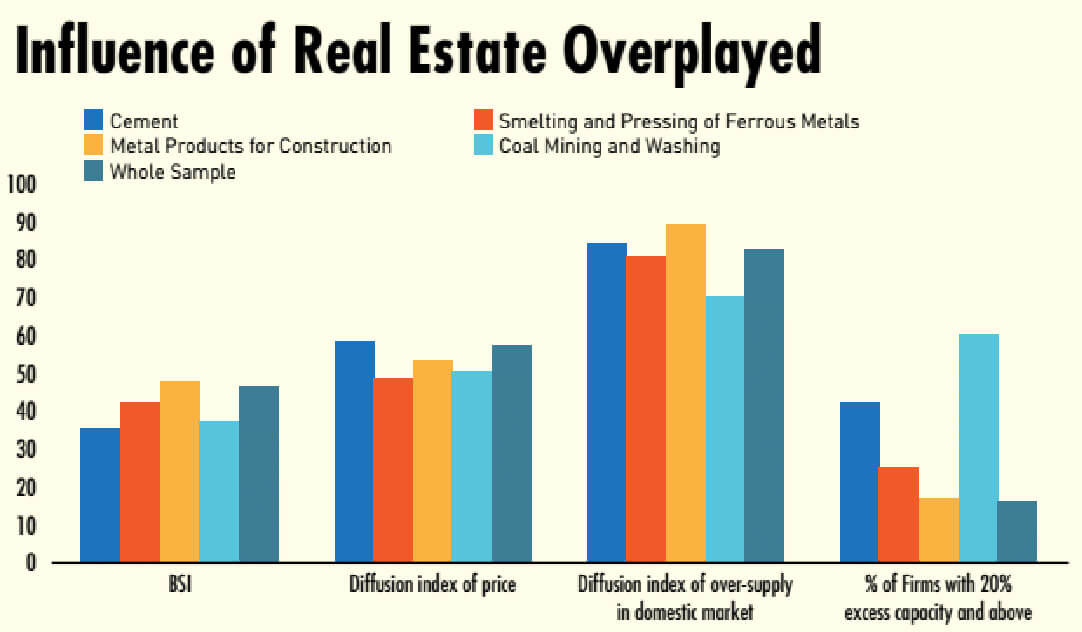

Influence of Real Estate Overplayed

- Contrary to the media discussion, the survey did not find the real estate sector to have an outsized influence on industrial growth

- With the exception of construction-related metal products, the business sentiment, operating conditions and production indices of real estate-related industries were below that of the whole sample

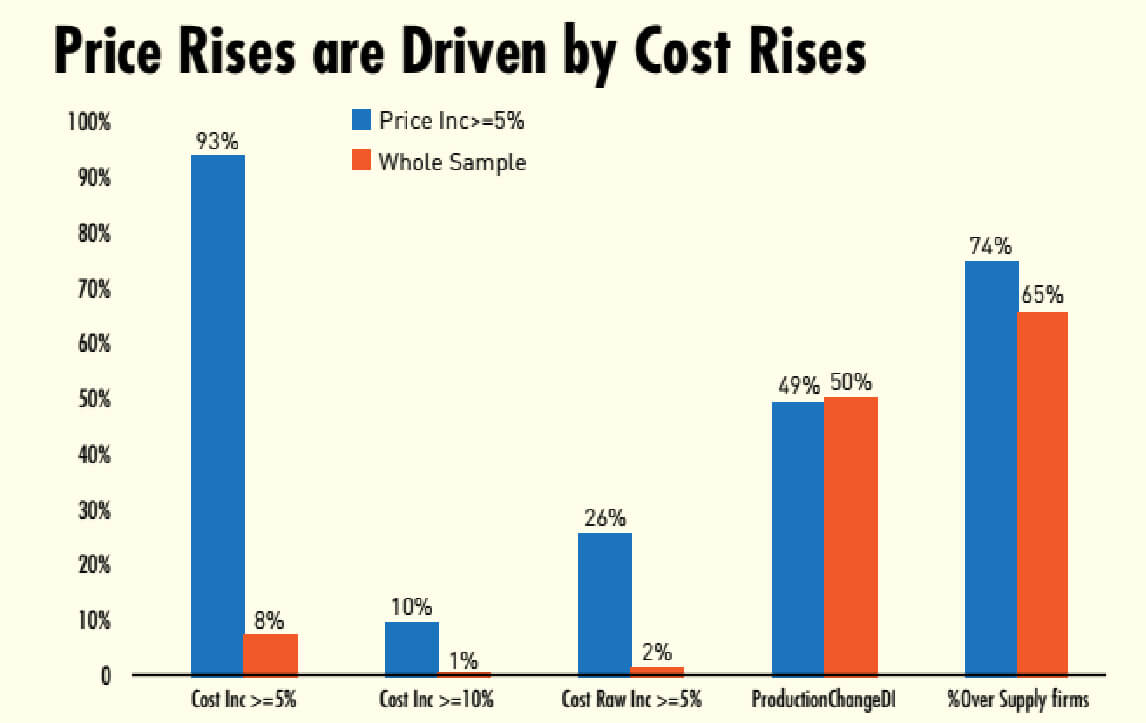

Price Rises are Driven by Cost Rises

- Among firms with product cost inflation above 5%, cost rises were the most prominent

- The proportion of firms with unit cost increases above 5% and 10% were 93% and 10%, respectively

- Unit cost increases are mostly related to raw material costs—26% of these firms reported raw materials cost rises above 5%

Conclusion

- The biggest challenge facing the industrial economy is still overcapacity. Both its prevalence and severity remain at close to historically high levels

- Supply-side reform this year should focus on the reduction of overcapacity, while facilitating industrial consolidation to improve overall competitiveness