With new logistics routes opening up and undersea resources becoming available as Arctic ice melts, what will China’s role be at the top of the world?

With new logistics routes opening up and undersea resources becoming available as Arctic ice melts, what will China’s role be at the top of the world?

While the world has been distracted by the pandemic, long-term climate change issues have raged on with massive forest fires in Australia and California, devastating flooding in Central Asia and the continued melting of the two poles. A warmer planet presents problems for us all, but also commercial opportunities, particularly in the Arctic, where China appears to be becoming a major player.

New logistics routes, vast areas of undersea resources and tourism are three ways the defreezing of the Arctic is going to change the world. And China is determined to have a significant role in the region despite it not being officially classified as an Arctic state.

“The melting ice … provides economic opportunities for the development of the Arctic, including for the Asian countries,” said Gao Feng, China’s special representative for Arctic Affairs, at the October 2019 Arctic Circle conference in Reykjavík, Iceland.

Disastrous melting

The Arctic Circle consists of the Arctic Ocean, adjacent seas and parts of Canada, Finland, Greenland, Iceland, Norway, Russia, Sweden and the United States (Alaska)—which are collectively known as the eight Arctic states. The Arctic states are officially recognized as stewards of the region. Both national jurisdictions and international law govern the lands surrounding the Arctic Ocean and its waters. The Northern provinces of the Arctic states are also home to more than 4 million Indigenous people.

The region is warming significantly faster than climate scientists had previously expected, with a persistent heatwave in the summer of 2020 providing average temperatures around ten degrees Celsius above historic norm, according to the Copernicus Climate Change Service.

Canada’s 4,000-year-old Milne Ice Shelf broke off into the Arctic Ocean in August 2020, because of both warmer water and hotter air. As Canada’s last fully intact ice shelf, it shrunk the remaining mass by 43%—more than 30 square miles, which is bigger than the size of Manhattan, according to the Yale School of the Environment. Many of the Earth’s other ice shelves have also collapsed due to rising temperatures.

While the extent of the Arctic ice shelf waxes and wanes depending on the season, research from the National Snow and Ice Data Center revealed that on 15 September 2020, the Arctic ice reached its minimum extent in recent history, at 3.74 million square kilometers. Apart from rising sea levels around the world it is leading to a fast growth in human activity in the region.

“One thing we know for sure is that the ice will continue to melt,” says Malte Humpert, Senior Fellow and Founder of The Arctic Institute, a research and policy institute based in Washington DC. “The long-term trend is set to be less ice overall and that the annual period that the Arctic is navigable for traffic will become longer and longer. It’s just a matter of time before we see an ice-free Arctic.”

“Based on developments, including the fact that we saw very low levels of ice in the summer of 2020, it’s been suggested that we might be seeing a situation whereby the entire Arctic Ocean is more or less ice free by 2035,” says Marc Lanteigne, Senior Research Fellow at the Norwegian Institute of International Affairs. “That would be a very significant environmental shift.”

Smooth sailing

Since the late 2000s, the shrinkage of the Arctic ice shelf has presented growing opportunities for shipping lines to reroute their cargo ships away from the longer, traditional routes closer to the equator linking the Americas with Europe and Asia. The last few years have seen growing numbers of commercial ships taking the much shorter, cheaper and faster routes across the roof of the world.

Currently the most important routes across the Arctic Ocean are the Northern Sea Route (NSR) running west from the Bering Strait along the Siberian coast, or east through the Canadian Arctic Archipelago, the Northwest Passage (NWP). A third route called the Arctic Bridge (AB) provides a shorter path through to Canada and Northern Europe.

These routes are generally only open in summer unless a ship is escorted by an ice breaker. However, in 2017, the first ship made it through in winter without an ice breaker, so shipping companies are increasingly investing in vessels that can break through thin ice.

For China, the Arctic offers shorter and cheaper alternatives to current shipping routes, which reach major markets in Europe via either the Indian ocean and the Suez Canal or the Pacific and the Panama Canal. For instance, a voyage from Shanghai to Hamburg via the NSR shaves 30% of the distance off a similar trip via the Suez Canal and avoids the pirates operating in the Strait of Malacca and in waters off the Horn of Africa. The operators can either arrive at their destinations early or use the extra time for super-slow sailing, reducing fuel costs and emissions.

A round-trip from Shanghai to Rotterdam via the NSR takes about 50 days and costs around $1.13 million. Going via the Suez Canal requires 60 days and about $1.5 million, according to research published by the Sustainability academic journal. The number of cargo vessels that transited the NSR rose from five in 2013 to 71 in 2019.

The Suez Canal, meanwhile, has an annual throughput of 17,000 ships. The volume of shipping sent through the Arctic is expected to grow sharply. Russia is investing tens of billions of dollars in the constructions of new Arctic ports in the hope that the region will emerge as a serious challenger to the Suez Canal.

“There are a lot of opportunities for companies making icebreakers and specialist vessels for shipment in the Arctic. Shipping companies like MAERSK will also be well placed to benefit from the opening of the NSR and the other sea routes,” says Olena Borodyna, Research Officer in the Global Risks and Resilience team at the Overseas Development Institute, a research and policy thinktank based in London.

“In terms of shipping routes, China has been using the Northern Sea Route for cargo shipments already, so that’s definitely going to intensify,” Borodyna notes. “Consumers will benefit, too, as the new shipping routes shorten the transit time between northern Europe and East Asia which will be reflected in consumer prices.”

China is investing heavily in the increasingly ice-free Northern Sea Route, which promises to cut shipping times between the Far East and Europe by ten to 15 days. “As China produces more cars needing to be exported to Europe or requires more European luxury cars to be shipped back, the Arctic route might come into greater use,” says Humpert. “Figures indicate you could save about $500 per vehicle on a mid-sized compact car in terms of shipping costs.”

But there are challenges to shipping along these new routes. Even during the summer, unpredictable weather and ice floes make navigation difficult. Ships often require an icebreaker escort, which can cost $400,000 plus additional insurance that offset potential savings. Finally, while the NSR may provide a viable alternative for shipping bulk cargo such as oil, coal and ore, it may be of less value for container shipping, which operates on a tighter delivery schedule. Many analysts believe it will take at least ten years of further warming before large volume shipping through the Arctic is practical.

Hidden resources

Underneath the Arctic Circle lie massive oil and natural gas formations. The United States Geological Survey estimates that the region contains approximately 13% of the world’s undiscovered oil resources and 30% of undiscovered natural gas resources. Melting ice provides greater access to these mineral deposits laying under the sea and the frozen lands bordering the Arctic. So far, most exploration has occurred on land, which accounts for a third of the Arctic’s area.

“From the US side, it’s quite unpredictable,” says Borodyna. “Under the Biden administration, the Arctic Wildlife Refuge in Alaska will not be explored for gas and oil for the next four years, but what will happen afterwards is unclear. China, Russia and other countries involved in natural gas extraction will continue building their projects and exploring for gas and oil.”

Russia has been keen to invest because its economy relies heavily on hydrocarbons. Of the nearly 60 large oil and natural-gas fields so far discovered in the Arctic, 43 are in Russia, 11 in Canada, six in Alaska and one in Norway, according to a 2009 US Department of Energy report.

“When it comes to economic opportunity in the Arctic, I think China’s emphasis has been placed for now on cooperation with Russia,” says Lanteigne. “This is where we see most of the tangible examples of the polar Silk Road, like the liquified natural gas (LNG) projects, and also greater interest in using the northern sea route for shipping.”

But there are other opportunities emerging as the ice melts.

“There has primarily been a focus on mega projects like oil and gas, but there is growing interest in developing tourism and the infrastructure required to receive them,” says Elana Wilson Rowe, Research Professor at the Norwegian Institute of International Affairs. “There has also been interest in seeing how economic development can benefit communities of Indigenous people who live in the Arctic.”

China’s position

From the moment that it became clear that the Arctic was opening, China has been actively stating its case for significant involvement. “China hopes to work with all parties to build a ‘Polar Silk Road’ through developing the Arctic shipping routes,” said China’s 2018 official policy paper on the polar region. It also stated that every country’s “rights to use the Arctic shipping routes should be ensured.”

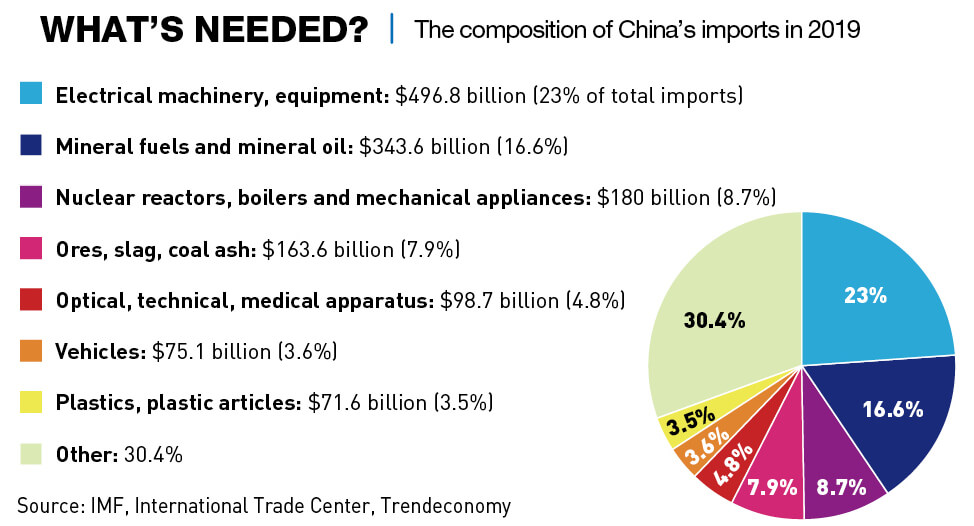

According to the policy paper, China acknowledges interests in oil and gas, minerals, fishing and other resources in the region, but expresses an interest in developing those resources with other nations based on principles of “respect, cooperation, win-win results and sustainability.”

“China is a passive receiver of natural gas and oil resources, not an active participant besides providing funding and some industrial know-how in construction,” says Humpert. “But the country has long-term economic interest in the Arctic, particularly in access to shipping lanes and building LNG carriers.”

Consider it as early moves in a chess game, says Humpert. “You’re getting all of your pieces in the right position so that in the next ten to 30 years, you are in a position to benefit from whatever happens in the Arctic.”

“China’s Arctic position is based on three pillars, the first being scientific diplomacy,” says Lanteigne from the Norwegian Institute of International Affairs. “What is happening in the Arctic is having a significant impact on Chinese weather, such as heavy rainstorms and colder temperatures. What China is seeking to do is to better understand the connection between changes in the Arctic and the direct effects on China.”

The second pillar, he says, is economic activity. China has been active in partnering with Russia to develop LNG projects. The third pillar, which is less defined, is governance. China has said it would like a stronger voice in emerging issues in the Arctic.

For example, China has been a formal observer on the Arctic Council in Tromsø since 2013, which means they can participate in activities but cannot vote. Voting is reserved for members of the eight Arctic states. “China has said that even though it doesn’t have any Arctic geography, it still wants a role in discussions about Arctic governance,” explains Lanteigne. “It argues there are certain areas of the Arctic which are international in scope and that there should be a role for non-Arctic states to play.”

China’s position is controversial. The Trump administration was extremely critical, saying that the Arctic is primarily of interest to Arctic states only.

China’s statements on sustainable economic development and environmental issues resonated well globally during the Trump administration. When the US withdrew from the Paris accords, China remained the largest economy still part of the agreement. And the fate of the Arctic is one of the top environmental issues the world faces.

“There are positive aspects and aspects where work needs to be done,” says Humpert. “The positive is that China is a big investor in renewable energy. If you look at the solar and wind energy projects being constructed in China, it surpasses every country … but China is obviously the largest polluter in the world, more than the EU and US combined.”

The great game

Many analysts thought that the melting of Arctic ice would create significant international competition for control of the sea lanes and resources. So far it does not appear to be playing out that way.

“In terms of challenging sovereignty and international law, there is no sign of China doing that,” says Lanteigne. “Where the situation gets complicated is when the Arctic opens up to new economic activity and discussions about international security. Then we are going to see more ships enter the region. It is there where China has said that there should be greater participation for non-Arctic states in dealing with issues, because what’s happening in the Arctic does have a global dimension.”

While the melting of Arctic ice is an environmental tragedy, it is also a huge opportunity for China in terms of logistics and stepping up on the global stage to fight climate change. Global warming has provided the country with an opportunity to become a significant player in yet another part of the world.

“There’s always a risk in predicting that tomorrow’s weather will be somewhat like today’s,” says Rowe from the Norwegian Institute of International Affairs. “But the fact that Arctic states all have significant economic interests in the region points in the direction that they will continue over the next decade to work on managing conflict and finding opportunities to cooperate. Arctic states would like to show that they can manage this region within the framework provided by the Arctic Council and the United Nations Convention for the Law of the Sea.”